Jefferson Countys General Fund began the year 2020 with the following account balances: During 2020, Jefferson experienced

Question:

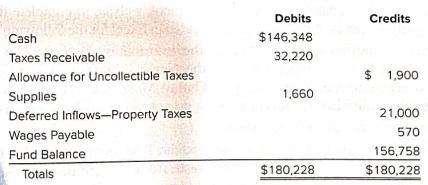

Jefferson County’s General Fund began the year 2020 with the following account balances:

During 2020, Jefferson experienced the following transactions:

1. The budget was passed by the County Commission, providing estimated revenues of $286,000 and appropriations of $233,000 and estimated other financing uses of $40,000.

2. Encumbrances totaling $4,800 outstanding at December 31, 2019, were re-established.

3. The Deferred Inflows—Property Taxes at December 31, 2019, is recognized as revenue in the current period.

4. Property taxes in the amount of $288,000 were levied by the County. It is estimated 0.5 percent (1/2 of 1 percent) will be uncollectible.

5. Property tax collections totaled $263,400. Accounts totaling $1,850 were written off as uncollectible.

6. Encumbrances were issued for supplies in the amount of $37,100.

7. Supplies in the amount of $40,500 were received. Jefferson County records supplies as an asset when acquired. The related encumbrances for these items totaled $41,000 and included the $4,800 encumbered last year. The County paid $38,100 on accounts payable during the year.

8. The County contracted to have alarm systems (capital assets) installed in the administration building at a cost of $42,900. The systems were installed and the amount was paid.

9. Paid wages totaling $135,900, including the amount payable at the end of 2019. (These were for general government operations.)

10. Paid other general government operating items of $7,600.

11. The General Fund transferred $39,800 to the debt service fund in anticipation of bond interest and principal payments. Additional Information

12. Wages earned but unpaid at the end of the year amounted to $890.

13. Supplies of $350 were on hand at the end of the year. (Supplies are used for general government operations.)

14. A review of property taxes receivable indicates that $23,000 of the outstanding balances would likely be collected more than 60 days after year-end and should be deferred.

Required:

Use the Excel template provided on the textbook website to complete the following requirements. A separate tab is provided in Excel for the following

items:

a. Prepare journal entries to record the information described in items 1 to 14. Classify expenditures in the General Fund as either General Government or Capital Outlay. Make entries directly to these and the individual revenue accounts; do not use subsidiary ledgers.

b. Post these entries to T-accounts.

c. Prepare closing journal entries; post to the T-account provided. Classify fund balances assuming there are no restricted or committed net resources and the only assigned net resources are the outstanding encumbrances.

d. Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balance for the General Fund for the year ending 2020. Use Excel formulas to calculate the cells shaded in blue.

e. Prepare a Balance Sheet for the General Fund as of December 31, 2020.

Step by Step Answer:

Essentials Of Accounting For Governmental And Not-for-Profit Organizations

ISBN: 9781260570175

14th Edition

Authors: Paul Copley