The City of Evansville operated a summer camp program for at-risk youth. Businesses and nonprofit organizations sponsor

Question:

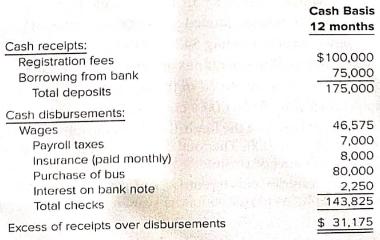

The City of Evansville operated a summer camp program for at-risk youth. Businesses and nonprofit organizations sponsor one or more youth by paying the registration fee for program participants. The following Schedule of Cash Receipts and Disbursements summarizes the activity in the program’s bank account for the year.

1. At the beginning of 2020, the program had unrestricted cash of $18,000.

2. The loan from the bank is dated April 1 and is for a five-year period. Interest (6 percent annual rate) is paid on October 1 and April 1 of each year, beginning October 1, 2020.

3. The bus was purchased on April 1 with the proceeds provided by the bank loan and has an estimated useful life of five years (straight-line basis—use monthly depreciation).

4. All invoices and salaries related to 2020 had been paid by close of business on December 31, except for the employer’s portion of December payroll taxes, totaling $800.

a. Prepare the journal entries, closing entries, and a Statement of Revenues, Expenses, and Changes in Fund Net Position assuming the City intends to treat the summer camp program as an enterprise

fund.

b. Prepare the journal entries, closing entries, and a Statement of Revenues, Expenditures, and Changes in Fund Balance assuming the City intends to treat the summer camp program as a special revenue fund.

Step by Step Answer:

Essentials Of Accounting For Governmental And Not-for-Profit Organizations

ISBN: 9781260570175

14th Edition

Authors: Paul Copley