Bert Baker had ($ 50,000) salary during 2018 and had the following capital gains and losses: How

Question:

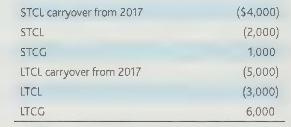

Bert Baker had \(\$ 50,000\) salary during 2018 and had the following capital gains and losses:

How should Bert treat the above on his 2018 tax return?

Transcribed Image Text:

STCL carryover from 2017 STCL STCG LTCL carryover from 2017 LTCL LTCG ($4,000) (2,000) 1,000 (5,000) (3,000) 6,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (8 reviews)

To determine how Bert should treat the capital gains and losses on his 2018 tax return we need to follow the IRS guidelines for reporting capital gains and losses Heres how Bert should handle each item ShortTerm Capital Loss STCL Carryover from 2017 Bert can use the shortterm capital loss carryover from 2017 to offset any capital gains he had in 2018 Since theres no specific information on shortterm capital gains in 2018 lets assume there were none Bert can use the 4000 STCL carryover to offset other gains ShortTerm Capital Loss STCL Bert incurred a shortterm capital loss of 2000 in 2018 This loss can offset any shortterm capital gains Bert may have had during the year If there were no shortterm capital gains Bert can use this loss to offset his other taxable income up to 3000 with any excess carried forward to future years ShortTerm Capital Gain STCG Bert had a shortterm capital gain ...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Bert Baker had $50,000 salary during 2019 and had the following capital gains and losses: How should Bert treat the above on his 2019 tax return? STCL carryover from 2018 STCL STCG LTCL carryover...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

On April 1 of the current taxable year, Mr. Lasing Gho died leaving Php 25, 000, 000 of net distributable estate. He also left behind Tessie, his legitimate wife; Rhealyn, his legally adopted...

-

Cars arrive at Wendy's drive-through at a rate of 0.2 car per minute between the hours of 11:00 p.m. and 1:00 a.m. on Saturday evening. Wendy's begins an advertising blitz that touts its late-night...

-

Using a contribution margin format income statement to measure the magnitude of operating leverage Willig Company, a merchandising firm, reported the following operating results: .:. Required a....

-

E18-2 Financial reporting during bankruptcy Use the following information in answering questions 1 and 2: Hal Company filed for protection from creditors under Chapter 11 of the bankruptcy act on...

-

Interstate 81 through southwest Virginia is heavily traveled by long-distance truckers. To cut down on accidents, The Virginia State Patrol carries out random inspections of a trucks weight and the...

-

Question 2 (9 points) On January 1, 2020, CC Company acquired 60,000 shares of RR Limited at $5 per share, representing 20% of RR's outstanding voting shares. On July 31, 2020, RR declared and paid a...

-

Cannon Corporation had a net long-term capital gain of \(\$ 50,000\) and a net short-term capital loss of \(\$ 75,000\) in 2018 . What are the tax consequences to Cannon as a result of its capital...

-

Gordon Grumps is married and files separately. During 2018, he had the following capital gains and losses: Gordon's taxable income is \(\$ 6,000\). What is Gordon's capital loss deduction for 2018...

-

A local television station must show commercial X twice, commercial Y twice, and commercial Z three times during a 2-hour show. How many different ways can this be done?

-

Compared to other majornations, the United States spends________ on health care and achieves________ efficiency. A. more; about the same B. about thesame; less C. more; less D. less; less E. less;...

-

Studying other cultures through a humanistic lens allows people to understand how different cultures came about and how and why people behave differently from one place to another (Lombrozo, 2015)....

-

4. Assume that G and T are exogenous, and C is determined by the standard. consumption function, but that investment is now endogenous and responds to income: I = b + bY. Assume c + b < 1. (a)...

-

4. You have decided it's time to buy a house, and you have found the one you want. The price is $500,000, and you will pay 10% in cash and will take a mortgage on the balance. The annual interest...

-

Differentiate. G(x) = (2x+3) (9x+ (x) G'(x)=

-

Consider a position consisting of a $300,000 investment in gold and a $500,000 investment in silver. Suppose that the daily volatilities of these two assets are 1.8% and 1.2%, respectively, and that...

-

What is the difference between the straight-line method of depreciation and the written down value method? Which method is more appropriate for reporting earnings?

-

Under what circumstances is the dividends- received deduction on a given dividend received not available?

-

What is the purpose of the dividends-received deduction? What corporations are entitled to claim this deduction? What dividends qualify for this deduction?

-

What is the special depreciation recapture rule that applies to corporations?

-

7 . 4 3 Buy - side vs . sell - side analysts' earnings forecasts. Refer to the Financial Analysts Journal ( July / August 2 0 0 8 ) study of earnings forecasts of buy - side and sell - side analysts,...

-

Bond P is a premium bond with a coupon of 8.6 percent , a YTM of 7.35 percent, and 15 years to maturity. Bond D is a discount bond with a coupon of 8.6 percent, a YTM of 10.35 percent, and also 15...

-

QUESTION 2 (25 MARKS) The draft financial statements of Sirius Bhd, Vega Bhd, Rigel Bhd and Capella for the year ended 31 December 2018 are as follows: Statement of Profit or Loss for the year ended...

Study smarter with the SolutionInn App