Bill decided to incorporate his printing business and to give his manager, Charlie, a share in the

Question:

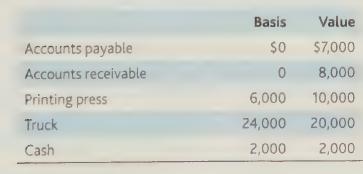

Bill decided to incorporate his printing business and to give his manager, Charlie, a share in the business. Bill's sole proprietorship transferred the following to Tom Co.:

Bill received 70 shares of the stock, worth $29,000. Charlie invested $2,000 in cash and received the remaining 30 shares of the stock.

What are the tax consequences to Bill, Charlie, and Tom Co.?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: