Donor Corporation had the following income and deductions for last year: Donor Corporation also made contributions (not

Question:

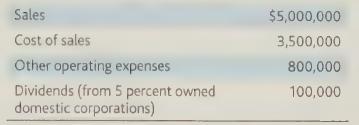

Donor Corporation had the following income and deductions for last year:

Donor Corporation also made contributions (not included above) to qualifying charitable organizations of $175,000. Determine Donor Corporation's taxable income for the year.

Transcribed Image Text:

Sales Cost of sales Other operating expenses Dividends (from 5 percent owned domestic corporations) $5,000,000 3,500,000 800,000 100,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Talsa, Inc., an all-equity firm, operates in the growing electric vehicle market. Over the next three years (T=1,2,3), Talsa, Inc., is expected to generate FCF of $2.4 billion, $3.6 billion, and $5.0...

-

Donor Corporation had the following income and deductions for last year: Donor Corporation also made contributions (not included above) to qualifying charitable organizations of \(\$ 175,000\)....

-

COMPREHENSIVE INDIVIDUAL TAX RETURN PROBLEM PAUL C. TURNER - 2022 Introduction: Every student will have four weeks to work on one of the four versions of the Paul Turner case. There will be 20...

-

Gabriele Enterprises has bonds on the market making annual payments, with seven years to maturity, a par value of $1,000, and selling for $974. At this price, the bonds yield 7.2 percent. What must...

-

How is the revaluation of a non-current (fixed) asset reported?

-

At the instant the traffic light turns green, an automobile starts with a constant acceleration a of 2.2m/s2. At the same instant a truck, traveling with a constant speed of 9.5 m/s, overtakes and...

-

What benefits would be derived from the use of a single set of financial reporting standards across countries? LO4

-

The Graham Telephone Company may invest in new switching equipment. There are three possible outcomes, having net present worth of $6570, $8590, and $9730. The probability of each outcome is 0.3,...

-

62 63 64 56 57 58 59 60 61 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 A 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 fx (b) -2000 A Revenues Expenses B Total expenses Net...

-

Barbara sells an asset to her wholly-owned corporation. The asset has a basis of $32,000 and a fair market value at the time of the sale of $27,000. What is the corporation's recognized gain or loss...

-

Ludlow Corporation has excess inventory that it no longer wants. In order to clear out its warehouse to make room for shipments of new inventory, it has decided to donate the inventory (bedding...

-

Two Carnot air conditioners, A and B, are removing heat from different rooms. The outside temperature is the same for both rooms, 309.0 K. The room serviced by unit A is kept at a temperature of...

-

Which of the five hazardous attitudes do you display most frequently? What can you do to minimize the presence and impact of these attitudes in your life?

-

What brought you to this course? How do you define Black or Blackness? What do you hope to get out of this class? When you think of Black Culture, what is the first thing that comes to mind? [For...

-

1. What is XBRL Taxonomy? How do you as a preparer of financial statement use the XBRL Taxonomy in locating a label for a specific financial element? 2. What are the benefits of adopting XBRL from...

-

What a business can do to protect and minimize the invasion of privacy for their customers? Think of your experience when visiting a website. What do most websites have you agree to before you do...

-

Based on your interest, skill set, or goals what do you typically contribute when working in groups? What do you need others to contribute due to your lack of interest, skill set, or goals? How do...

-

How can a baby boom cause problems for an unfunded pension system?

-

Design a circuit which negative the content of any register and store it in the same register.

-

In earlier years, neither Hugo nor Wanda, his wife, made any taxable gifts. In 2016, Hugo gave $14,000 cash to each of his nieces, nephews, and grandchildren, 30 persons in total. In 2017, Wanda...

-

In 2017, Homer and his wife, Wilma (residents of a non community property state) make the gifts listed below. Homers previous taxable gifts consist of $100,000 made in 1975 and $1.4 million made in...

-

In 2017, Henry and his wife, Wendy, made the gifts shown below. All gifts are of present interests. What is Wendys gift tax payable for 2017 if the couple elects gift splitting and Wendys previous...

-

7 . 4 3 Buy - side vs . sell - side analysts' earnings forecasts. Refer to the Financial Analysts Journal ( July / August 2 0 0 8 ) study of earnings forecasts of buy - side and sell - side analysts,...

-

Bond P is a premium bond with a coupon of 8.6 percent , a YTM of 7.35 percent, and 15 years to maturity. Bond D is a discount bond with a coupon of 8.6 percent, a YTM of 10.35 percent, and also 15...

-

QUESTION 2 (25 MARKS) The draft financial statements of Sirius Bhd, Vega Bhd, Rigel Bhd and Capella for the year ended 31 December 2018 are as follows: Statement of Profit or Loss for the year ended...

Study smarter with the SolutionInn App