Donor Corporation had the following income and deductions for last year: Donor Corporation also made contributions (not

Question:

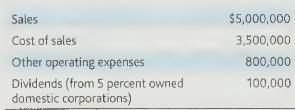

Donor Corporation had the following income and deductions for last year:

Donor Corporation also made contributions (not included above) to qualifying charitable organizations of \(\$ 175,000\). Determine Donor Corporation's taxable income for the year.

Transcribed Image Text:

Sales Cost of sales Other operating expenses Dividends (from 5 percent owned domestic corporations) $5,000,000 3,500,000 800,000 100,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Talsa, Inc., an all-equity firm, operates in the growing electric vehicle market. Over the next three years (T=1,2,3), Talsa, Inc., is expected to generate FCF of $2.4 billion, $3.6 billion, and $5.0...

-

Donor Corporation had the following income and deductions for last year: Donor Corporation also made contributions (not included above) to qualifying charitable organizations of $175,000. Determine...

-

COMPREHENSIVE INDIVIDUAL TAX RETURN PROBLEM PAUL C. TURNER - 2022 Introduction: Every student will have four weeks to work on one of the four versions of the Paul Turner case. There will be 20...

-

Pantheon Gaming, a computer enhancement company, has three product lines: audio enhancers, video enhancers, and connection-speed accelerators. Common costs are allocated based on relative sales. A...

-

To estimate proportions using bootstrapping methods, report successes as 1 and failures as 0. Then follow the same procedures that we used to estimate a mean using bootstrapping. Suppose a random...

-

How should the control volume method be implemented at an interface between two materials with different thermal conductivities? Illustrate with a steady, one-dimensional example. Neglect contact...

-

What are rules for success? Why is it important to determine whether the rules for success have changed in an organization before a new system is implemented? AppendixLO1

-

On June 1, Federia Inc. issues 4,000 shares of no-par common stock at a cash price of $6 per share. Journalize the issuance of the shares assuming the stock has a stated value of $2 per share.

-

"I know headquarters wants us to add thot new product line" said Dell Havasi, manager of Billings Company's Office Products Division But I want to see the numbers before I make any move. Our...

-

Barbara sells an asset to her wholly-owned corporation. The asset has a basis of \(\$ 32,000\) and a fair market value at the time of the sale of \(\$ 27,000\). What is the corporation's recognized...

-

Ludlow Corporation has excess inventory that it no longer wants. In order to clear out its warehouse to make room for shipments of new inventory, it has decided to donate the inventory (bedding...

-

Determine the missing data for each letter in the following three income statements for Sampson Paper Company (in thousands): 2010 2009 2008 Sales $572 Sales returns and allowances 48 38 Net sales...

-

IV. Normal Distribution 9. IQ scores are said to be normally distributed with a mean of 100 and a standard deviation of 15. Label the normal curve below and then answer the questions that follow. a....

-

Manually determine the range, variance, and standard deviation of the set of numbers. Show the computations: a. 3, 8, 10, 14, 9, 10, 12, 21, 5, 13, 11, 10 b. 232, 212, 151, 325, 142, 132, 142, 236,...

-

Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation...

-

1 Frequency Domain Analysis 1. Given an input u(t) = cos(t) + 2 sin(5t) cos(5t) which is a sum of a lower frequency signal and a higher-frequency noise. Determine the feasible range of time constant...

-

A motor supplies a constant torque or twist of M = 120 lb ft to the drum. If the drum has a weight of 30 lb and a radius of gyration of ko = 0.8 ft, determine the speed of the 15-lb crate A after it...

-

Virtually all students have heard of IKEA, but only a few will have ever visited an IKEA store. For that reason, it is a good idea to direct students to the IKEA website or an IKEA catalog prior to...

-

Decades after the event, Johnson & Johnson (J&J), the 130-year-old American multinational, is still praised for swiftly The company indicated that its response was based on the expectations set forth...

-

In an S corporation, how are items of income, deductions, and credits divided among the shareholders?

-

A C corporation has an unused net operating loss carryover at the end of 2019. The corporation elects S corporation status at the beginning of 2020. What happens to the unused net operating loss...

-

What is the special treatment of S corporation expenses owed to shareholders? How does this treatment differ from that of a C corporation?

-

On January 1, 2018, Brooks Corporation exchanged $1,259,000 fair-value consideration for all of the outstanding voting stock of Chandler, Inc. At the acquisition date, Chandler had a book value equal...

-

1. Determine the value of the right to use asset and lease liability at commencement of the lease.

-

Problem 22-1 The management of Sunland Instrument Company had concluded, with the concurrence of its independent auditors, that results of operations would be more fairly presented if Sunland changed...

Study smarter with the SolutionInn App