Jack Dillon and Jake Johnson each own 50 percent of the capital interests in the JJ partnership.

Question:

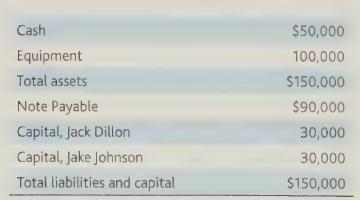

Jack Dillon and Jake Johnson each own 50 percent of the capital interests in the JJ partnership. They share profits equally, but they agree to allocate 60 percent of the losses to Jack and 40 percent to Jake. The note payable is a recourse liability. The tax-basis balance sheet at the end of the year is as follows:

Determine how much of the liability is allocable to each partner.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: