Jean Kelley owned three limited partnership interests in 2018: How much is her passive loss deduction (against

Question:

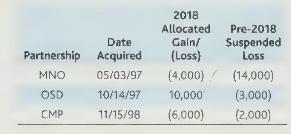

Jean Kelley owned three limited partnership interests in 2018:

How much is her passive loss deduction (against nonpassive activities) and suspended loss for each activity?

Transcribed Image Text:

2018 Allocated Date Gain/ Partnership Acquired (Loss) MNO 05/03/97 (4.000) OSD 10/14/97 10,000 CMP 11/15/98 (6,000) Pre-2018 Suspended Loss (14,000) (3,000) (2.000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

To calculate Jean Kelleys passive loss deduction and suspended loss for each limited partnership interest we need to consider the allocated gains or l...View the full answer

Answered By

Fazil P

I am a Civil Engineering Student. I am currently studying at NIT Calicut which is one of the best engineering colleges in India.I got in this college by cracking one of the toughest exam in India, JEE exam. I completed my Higher secondary education with an aggregate percentage of 98% . I completed matriculation with full A+.

I like to share my knowledge and I often helps my classmates in academics. I used to tutor high school students in their studies.

0.00

0 Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Jean Kelley owned three limited partnership interests in 2019: How much is her passive loss deduction (against nonpassive activities) and suspended loss for each activity? 2019 Allocated Pre-2019...

-

Tammy Faye Jones owned three passive activities in 2018 (she had no suspended losses prior to 2018): How much is her passive loss deduction (against nonpassive income) and suspended loss for each...

-

Tammy Faye Jones owned three passive activities in 2019 (she had no suspended losses prior to 2019): How much is her passive loss deduction (against nonpassive income) and suspended loss for each...

-

Apply normalization (1NF, 2NF and 3NF) of the system description given below and justify why relation needs 1NF, 2NF, and 3NF or not. At the end shift normalized data into Un-Normalized Data. S ystem...

-

Violent crimes include rape, robbery, assault, and homicide. The following is a summary of the violent-crime rate (violent crimes per 100,000 population) for all 50 states in the United States plus...

-

Recording, Reporting, and Evaluating a Bad Debt Estimate During 2011, Dorothys Ceramics Shop had sales revenue of $70,000, of which $25,000 was on credit. At the start of 2011, Accounts Receivable...

-

Why closing stock is not shown in the trial balance?

-

1. Why would Amazon accept responsibility for the shipping problems of its vendors, UPS and FedEx? How would you feel about the companys response if you were among the customers who did not receive...

-

B Credit Debit $14,000 27,000 15,000 2,500 15,000 & $3,000 A 1 Trial Balance 2 December 31 3 4 Cash 5 Accounts receivable 6 Merchandise inventory 7 Prepaid insurance 8 Store equipment 9 Accumulated...

-

Teri Frazier owned three businesses and rental properties in 2018. During the year, her hair salon business experienced a \(\$ 32,000\) net loss. She participated 200 hours in the hair salon...

-

Brent Fullback owned four passive activity interests in 2018: On March 2, 2018, Fullback sold his entire interest in A-1 for \(\$ 15,000\). His basis in the activity on January 1, 2018, was \(\$...

-

What are the elements of an executive coaching relationship and their impact on employee performance, including team collaboration?

-

James A. and Ella R. Polk, ages 70 and 65, respectively, are retired physicians who live at 3319 Taylorcrest Street, Houston, Texas 77079. Their three adult children (Benjamin Polk, Michael Polk, and...

-

I need help solving the following question: - Thank you in advance. On January 1, Year 6, HD Lid., a building supply company, JC Lid., a construction company, and Mr. Saeid, a private investor,...

-

Let X 1 , , X n X 1 , , X n be a random sample from a normal distribution with mean and variance 1. Find the uniformly minimum variance unbiased estimator of 2 2 .2 answers

-

The ledger of Duggan Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. Debit Credit Prepaid Insurance $3,600 Supplies...

-

1.Using the Excel file Sales transaction find the following15 Marks a.Identify the levels of measurement for each variables b.Construct a cross tabulation to find the number of transactions by...

-

Calculate the value of nine-month American call option on a foreign currency using a three-step binomial tree. The current exchange rate is 0.79 and the strike price is 0.80 (both expressed as...

-

On July 1, 2011, Flashlight Corporation sold equipment it had recently purchased to an unaffiliated company for $480,000. The equipment had a book value on Flashlights books of $390,000 and a...

-

What is the applicable credit amount?

-

What is a domestic corporation?

-

Why can't a partner recognize loss upon receipt of a current distribution?

-

thumbs up if correct A stock paying no dividends is priced at $154. Over the next 3-months you expect the stock torpeither be up 10% or down 10%. The risk-free rate is 1% per annum compounded...

-

Question 17 2 pts Activities between affiliated entities, such as a company and its management, must be disclosed in the financial statements of a corporation as O significant relationships O segment...

-

Marchetti Company, a U.S.-based importer of wines and spirits, placed an order with a French supplier for 1,000 cases of wine at a price of 200 euros per case. The total purchase price is 200,000...

Study smarter with the SolutionInn App