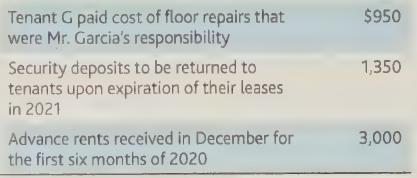

Mr. Garcia, a cash-basis taxpayer, owns an apartment building. His records reflect the following information for 2019:

Question:

Mr. Garcia, a cash-basis taxpayer, owns an apartment building. His records reflect the following information for 2019:

What is the amount of gross rental income Mr. Garcia should include in his gross income?

a. $2,300

b. $3,000

c. $3,950

d. $4,350

e. $5,300

Transcribed Image Text:

Tenant G paid cost of floor repairs that were Mr. Garcia's responsibility Security deposits to be returned to tenants upon expiration of their leases in 2021 Advance rents received in December for the first six months of 2020 $950 1,350 3,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

ANSWER The correct answer is b 3000 For a cashbasis taxpayer like Mr Garcia rental income is gen...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

1. Betty contributed property with a $40,000 basis and fair market value of $85,000 to the Rust Partnership in exchange for a 50% interest in partnership capital and profits. During the first year of...

-

Baldev is a CPA and sole practitioner. He started the practice five years ago and has managed to make enough from it to support his family. However, just over one-half of his income comes from a...

-

A thermocouple Type K is calibrated in lab condition at 50% relative humidity (RH) prior to outdoor operation. After 12-month in outdoor installation, the thermocouple is again tested at 75% RH. Both...

-

Mrs. Roberts, in a diabetic coma, has just been admitted to Noble Hospital. Her blood pH indicates that she is in severe acidosis (low blood pH), and measures are quickly instituted to bring her...

-

Diaz Company issued bonds with a $ 1 4 9 , 0 0 0 face value on January 1 , Year 1 . The bonds had a 6 percent stated rate of interest and a 1 0 - year term. Interest is paid in cash annually,...

-

EXERCISE 211 Varying Plantwide Predetermined Overhead Rates LO21, LO22, LO23 Kingsport Containers Company makes a single product that is subject to wide seasonal variations in demand. The company...

-

Presented below are three different lease transactions that occurred for Manitoba Inc. in 2012. Assume that all lease contracts start on January 1, 2012. In no case does Manitoba receive title to the...

-

The practice of having the stock listed and .11 traded on several foreign stock exchanges :is known as * (1 ) .cross-listing o consolidation o initial public offering O .SEC registration o

-

Joe signed for a ten-year lease to rent office space from Stanley. In the first year, Joe paid Stanley $5,000 for the first years rent and $5,000 as rent for the last year oft he lease How much must...

-

Faraway Travel, Inc. granted its vice-president, Chris Best, an incentive stock option on 1,000 shares of Faraway stock at $25 a share, its fair market value, on July 22, Year 1. Chris exercised the...

-

Certification and licensure are essentially the same thing. A. True B. False

-

What type of corporate governance does Uniqlo utilise? (e.g. Agency Relationships, Ownerships Concentration, Membership of the Board of Directors (insiders, related outsiders, outsiders)). What type...

-

Air at a dbt (dry bulb temprature) of 30 C and a relative humidity of 30% is conveyed through a heated dryer where it is heated to a dbt of 80 C. Then it is conveyed through a bed of granular pet...

-

Do you think McDonald's entry strategy was appropriate for the Indian market? Explain there strategy according to Indian market.

-

Please do detailed market strategy and target market for this device as described below. the target area is east African market. "Safe locater" is a company that will be formed committed to develop...

-

how do you define technical performance measures(TPM)? what are the key differences between design department parameters (DDP) andTechnical performance measures (TPM). References if possible

-

What is the relationship between quota sampling and judgmental sampling?

-

Graph the following conic sections, labeling vertices, foci, directrices, and asymptotes (if they exist). Give the eccentricity of the curve. Use a graphing utility to check your work. 10 5 + 2 cos 0

-

Assume the same facts as in Problem 36, except that the two shareholders consent to an AAA bypass election.

-

At the beginning of the tax year, Lizzie holds a $10,000 stock basis as the sole shareholder of Spike, Inc., an S corporation. During the year, Spike reports the following. Determine Lizzies stock...

-

Assume the same facts as in Problem 38, except that the cash distribution to Lizzie amounts to $40,000. Determine Lizzies stock basis at the end of the year, and the treatment of her cash...

-

crane Inc. common chairs currently sell for $30 each. The firms management believes that it's share should really sell for $54 each. If the firm just paid an annual dividend of two dollars per share...

-

Determine the simple interest earned on $10,000 after 10 years if the APR is 15%

-

give me an example of 10 transactions from daily routine that we buy and put for me Liabilities + Owners' Equity + Revenues - Expenses

Study smarter with the SolutionInn App