Ms. Santana is single and over 65 years old. She received the following income in 2019: She

Question:

Ms. Santana is single and over 65 years old.

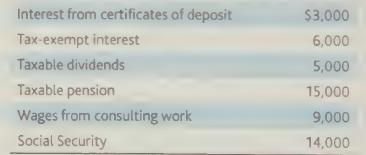

She received the following income in 2019:

She did not have any adjustments to income.

What is the taxable amount of Ms. Santana’s Social Security?

a. $7,000

b. $9;350

c. $11,000

d. $11,900

e. $13,850

Transcribed Image Text:

Interest from certificates of deposit Tax-exempt interest Taxable dividends Taxable pension Wages from consulting work Social Security $3,000 6,000 5,000 15,000 9,000 14,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (5 reviews)

The taxable amount of Social Security for Ms Santana can be ...View the full answer

Answered By

Amit Kumar

I am a student at IIT Kanpur , which is one of the prestigious colleges in INDIA.

Cleared JEE Advance in 2017.I am a flexible teacher because I understand that all students learn in different ways and at different paces. When teaching, I make sure that every student has a grasp of the subject before moving on.

I will help student to get the basic understanding clear. I believe friendly behavior with student can help both the student and the teacher.

I love science and my students do the same.

4.90+

44+ Reviews

166+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Ms. Santana is single and over 65 years old. She received the following income in 2020: Interest from certificates of deposit $3,000 Tax-exempt interest 6,000 Taxable dividends 5,000 Taxable pension...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Steve Drake sells a rental house on January 1, 2012, and receives $130,000 cash and a note for $55,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $45,000....

-

A production line will be used to manufacture an item. The line will be operated with using the same personnel during single shift operations. During the initial line certification, the first item...

-

Use the information for Kemper Company from BE9-5. In 2015, Kemper paid $1,000,000 to obtain the raw materials which were worth $950,000. Prepare the entry to record the purchase?

-

The Sarah Free, Inc. produces handmade shoe bags made of leather used for high-end shoes. They created a production budget and for the next four months, they forecast the following units be produced:...

-

Extending the life of an aluminum smelter pot. An investigation of the properties of bricks used to line aluminum smelter pots was published in The American Ceramic Society Bulletin (Feb. 2005). Six...

-

Create a class named Pizza with data fields for description (such as sausage and onion) and price. Include a constructor that requires arguments for both fields and a method to display the data....

-

Windsor Airline needs to send out one of its employees to Nunavut for three weeks to perform some repairs on some aircraft it owns. Some of the payments to be made for the supplies needed on the...

-

On January 4, 2019, Ralph Stuart, an employee of Hard Manufacturing Inc., enrolled for the spring semester at State University where he is a candidate for an undergraduate degree in accounting. His...

-

Roger Corby, a student, was employed seven nights a week at the Campus Inn as a desk clerk. He was required to be on duty from 11 p.m. to 6 a.m. and on call at various other hours, although he was...

-

The following selected data were taken from the financial statements of Berry Group Inc. for December 31, 2008, 2007, and 2006: The 2008 net income was $112,500, and the 2007 net income was $135,000....

-

A new partner C is invited to join in the AB partnership. Currently, A's and B's capital are $540,000 and $100,000, respectively. According to their profit and loss sharing contract, partner A and B...

-

The two tanks shown are connect through a mercury manometer. What is the relation between ???? and ? water Az water Ah

-

1. After reading about the types of rights that prisoners have while incarcerated, which of these rights, if any, should be reduced or diminished? Why? 2. In the same way, what rights do you believe...

-

According to the Socratic view of morality summarized by Frankena, is a person brought up by immoral parents in a corrupt society capable of making correct moral judgements? Why or why not? Do you...

-

Loma Company manufactures basketball backboards. The following information pertains to the company's normal operations per month: Output units15,000 boards Machine-hours4,000 hours Direct...

-

Describe the basic principle involved in the atomic force microscope.

-

The manager for retail customers, Katie White, wants to hear your opinion regarding one business offer she has received from an entrepreneur who is starting a mobile phone app called Easy Money. The...

-

What type of geographic pricing policy is most appropriate for the following products (specify any assumptions necessary to obtain a definite answer): ( a ) a chemical by-product, ( b ) nationally...

-

How would a ban on freight absorption (that is, requiring F.O.B. factory pricing) affect a producer with substantial economies of scale in production?

-

Give an example of a marketing mix that has a high price level but that you see as a good value. Briefly explain what makes it a good value.

-

TestAnswerSavedHelp opens in a new windowSave & ExitSubmit Item 1 7 1 0 points Time Remaining 1 hour 2 0 minutes 1 8 seconds 0 1 : 2 0 : 1 8 Item 1 7 Time Remaining 1 hour 2 0 minutes 1 8 seconds 0 1...

-

Use the following information for the Problems below. (Algo) [The following information applies to the questions displayed below.] Lansing Company's current-year income statement and selected balance...

-

In the context of portfolio theory, what is diversification primarily intended to do ? A ) Increase returns. B ) Reduce risk. C ) Maximize tax efficiency. D ) Simplify investment management.

Study smarter with the SolutionInn App