Ralph Sample had the following income and deductions listed on his 2018 income tax return: Compute the

Question:

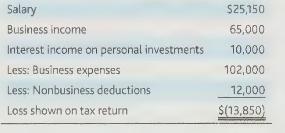

Ralph Sample had the following income and deductions listed on his 2018 income tax return:

Compute the amount of Ralph's 2018 net operating loss.

Transcribed Image Text:

Salary Business income Interest income on personal investments Less: Business expenses Less: Nonbusiness deductions Loss shown on tax return $25,150 65,000 10,000 102,000 12,000 $(13,850)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

To compute Ralphs net operating loss NOL for 2018 wel...View the full answer

Answered By

Ayush Mishra

I am a certified online tutor, with more than 3 years of experience in online tutoring. My tutoring subjects include: Physics, Mathematics and Mechanical engineering. I have also been awarded as best tutor for year 2019 in my previous organisation. Being a Mechanical Engineer, I love to tell the application of the concepts of science and mathematics in the real world. This help students to develop interest and makes learning fun and easy. This in turn, automatically improves their grades in the subject. I teach students to get prepared for college entry level exam. I also use to teach undergraduate students and guide them through their career aim.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Ralph Sample had the following income and deductions listed on his 2019 income tax return: Compute the amount of Ralphs 2019 net operating loss. Salary Business income Interest income on personal...

-

In 2018, Mary Jackson had the following income and deductions listed on her individual income tax return: Compute the amount of Mary's 2018 net operating loss. Business income Interest income on...

-

02. The competitive exclusion principle only applies when the niches of competing species have a high degree of overlap. O True False 54bmit Q3. Four snake species colonize an island at the same...

-

What does the five-number summary consist of?

-

Comparing Companies within an Industry Refer to the financial statements of American Eagle Outfitters in Appendix B, Urban Outfitters in Appendix C, and the Industry Ratio Report in Appendix D at the...

-

A company in Calgary serves a market in the northwestern United States. Now it ships LTL at an average cost of $28 per unit. If the company establishes a distribution center in the market, it...

-

Hall-Mark regularly supplied electronic parts to Peter Lee. On September 11, 1992, Lee gave Hall-Mark a $100,000 check for parts it had received. Hall-Mark continued to ship parts to Lee. On...

-

Consider the following series of investment projects available in your company: year A B C D 0 -$2,000 -$4,000 -$3,000 -$9,000 1 $400 $1,000 -$2,000 $2,000 2 $500 $1,500 $7,000 $2,000 3 $600 $2,000...

-

During 2018, Jane Mason incurred the following home expenses: Assume that Jane qualified for the home office deduction, all of the above expenditures qualified for the deduction as home office...

-

Max Computer Center incurred the following casualty and theft losses in 2018: Compute the casualty and theft loss for each item listed. Event b. C a. b. Robbery-Equip. Fire-Truck Fire-Equip. Event...

-

(a) Compare your answer in Problem 20 to the answer you would have found if you had used an un-weighted, 0-1 scoring model. Assume that a score of 1 means does not qualify and a 2 or 3 means it does...

-

Among 450 randomly selected drivers in the 16 - 18 age bracket, 374 were in a car crash in the last year. If a driver in that age bracket is randomly selected, what is the approximate probability...

-

Construct a 90% confidence interval for the population standard deviation o at Bank A. Bank A 6.4 6.6 6.7 6.8 7.1 7.2 7.6 7.8 7.8 7.8

-

In 2002, after the accounting deceptions of the management of many multi-million dollar corporations (with Enron being the benchmark name of that time period), the Security and Exchange Commission...

-

1.Deduce the structure of a compound with molecular formula CsH100 that exhibits the following IR, H NMR, and 13C NMR spectra. Data from the mass spectrum are also provided. Mass Spec. Data relative...

-

Transcribed image text: Prots Caco.ch Part 2 Income Statement Med Earningstemet Tante Sheet For the event.com Competence ended The fram C an an dy wana A TO nede ANG ore.com wwwwww og for to...

-

Show that the BlackScholesMerton formula for a call option gives a price that tends to max (So- K,0)

-

1. Firms may hold financial assets to earn returns. How the firm would classify financial assets? What treatment will such financial assets get in the financial statements in accordance with US GAAP...

-

List the various administrative sources of tax law.

-

Define the following type of SALTS: individual income, corporate income, sales, gross receipts, franchise, real property, personal property, unemployment, use, excise, transfer, and severance taxes.

-

What are the tax advantages associated with a qualified employer-sponsored plan?

-

Fig 1. Rolling a 4 on a D4 A four sided die (D4), shaped like a pyramid (or tetrahedron), has 4 flat surfaces opposite four corner points. A number (1, 2, 3, or 4) appears close to the edge of each...

-

I just need help with question #4 please! Thank you! Windsor Manufacturing uses MRP to schedule its production. Below is the Bill of Material (BOM) for Product A. The quantity needed of the part...

-

(25) Suppose that we have an economy consisting of two farmers, Cornelius and Wheaton, who unsurprisingly farm corn c and wheat w, respectively. Assume that both farmers produce their crop of choice...

Study smarter with the SolutionInn App