Ralph Sample had the following income and deductions listed on his 2019 income tax return: Compute the

Question:

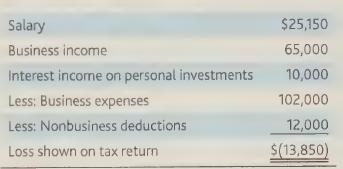

Ralph Sample had the following income and deductions listed on his 2019 income tax return:

Compute the amount of Ralph’s 2019 net operating loss.

Transcribed Image Text:

Salary Business income Interest income on personal investments Less: Business expenses Less: Nonbusiness deductions Loss shown on tax return $25,150 65,000 10,000 102,000 12,000 $(13,850)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answered By

ZIPPORAH KISIO LUNGI

I have worked on several other sites for more than five years, and I always handle clients work with due diligence and professionalism. Am versed with adequate experience in the fields mentioned above in which have delivered quality papers in research, thesis, essays, blog articles, and so forth.

I have gained extensive experience in assisting students to acquire top grades in biological, business and IT papers. Notwithstanding that, I have 7+ years of experience in corporate world software design and development.

5.00+

194+ Reviews

341+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Ralph Sample had the following income and deductions listed on his 2018 income tax return: Compute the amount of Ralph's 2018 net operating loss. Salary Business income Interest income on personal...

-

In 2019, Mary Jackson had the following income and deductions listed on her individual income tax return: Compute the amount of Marys 2019 net operating loss. Business income Interest income on...

-

Which of the below is the correct order of the consumption process? Question 2 options: Awareness; Thinking; Planning; Implementation/Action; Evaluation Evaluation; Thinking; Planning;...

-

1. People buy more of good 1 when the price of good 2 rises. These goods are A. substitutes. B. normal goods. C. inferior goods. D. complements. 2. The cost of making tennis shoes goes down. The...

-

Water at 300 K and a flow rate of 5 kg/s enters a black, thin-walled tube, which passes through a large furnace whose walls and air are at a temperature of 700 K. The diameter and length of the tube...

-

How does Etisalat ensure that their employees have access to quality career development programs? LO.1

-

An inexperienced accountant prepared this condensed income statement for Hight Company, a retail firm that has been in business for a number of years. HIGHT COMPANY Income Statement For the Year...

-

Aero Motorcycles is considering opening a new manufacturing facility in Fort Worth to meet the demand for a new line of solar - charged motorcycles ( who wants to ride on a cloudy day anyway? ) The...

-

During 2019, Jane Mason incurred the following home expenses: Assume that Jane qualified for the home office deduction, all of the above expenditures qualified for the deduction as home office...

-

Max Computer Center incurred the following casualty and theft losses in 2019: Compute the casualty and theft loss for each item listed. Event a. b. C. a. b. = C 11 Robbery-Equip. Fire-Truck...

-

Which of the following If clauses determines whether the chkTaxable control is selected? a. If chkTaxable = True Then b. If chkTaxable.Checked Then c. If chkTaxable.Selected Then d. If...

-

Based on contract law principles, do you think the jury\'s verdict against the Loewen Group for $ 5 0 0 million was appropriate? Why or why not? What factors should the jury have considered in...

-

5.) Consider you have two systems - one filled with (1kg) water and the other with (1kg) of air. Both systems are at 1000 kPa and 30 C. Determine numerically which fluid system has the larger...

-

Question 3: The partnership of Blossom, Blue, and Kingbird engaged you to adjust its accounting records and convert them uniformly to the accrual basis in anticipation of admitting Kerns as a new...

-

Instructions : Build an Excel spreadsheet using the accounting equation (Assets = Liabilities + Shareholders' Equity). Remember that each transaction has an equal effect on both the left-hand side...

-

7.3 Fill in the spreadsheet below to calculate the port- folio return and risk between Zenon and Dynamics, given the 10 years of annual returns for each stock and portfolio weights of 50/50. (a) How...

-

1. The international product life cycle theory says that a company will begin by exporting its product and later undertake what as the product moves through its life cycle? 2. Whenever optimizing...

-

After looking at the resources, explain what a spirit image is. Why might looking at a god and/or a human in terms of their spirit be helpful if you want to eliminate some of the divisions between...

-

a. What assets are excluded from capital asset status? b. Are capital gains given favorable tax treatment? c. What is the significance of an asset being classified as a capital asset? d. Are capital...

-

Is there any tax advantage for an individual who has held an appreciated capital asset for eleven months to delay the sale of the asset? Explain.

-

a. Explain the difference between income splitting and income shifting. b. Why are taxpayers interested in shifting income from one tax return to another within the same family or economic unit? c....

-

Famas Llamas has a weighted average cost of capital of 8.8 percent. The companys cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the...

-

The common stock of a company paid 1.32 in dividens last year. Dividens are expected to gros at an 8 percent annual rate for an indefinite number of years. A) If the company's current market price is...

-

(1 point) Bill makes annual deposits of $1900 to an an IRA earning 5% compounded annually for 14 years. At the end of the 14 years Bil retires. a) What was the value of his IRA at the end of 14...

Study smarter with the SolutionInn App