Susco had the following items this year: What is Suscos taxable income and does it have any

Question:

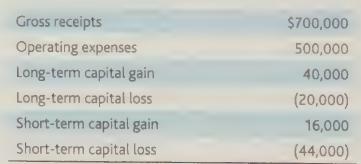

Susco had the following items this year:

What is Susco’s taxable income and does it have any carrybacks/carryovers?

Transcribed Image Text:

Gross receipts Operating expenses Long-term capital gain Long-term capital loss Short-term capital gain Short-term capital loss $700,000 500,000 40,000 (20,000) 16,000 (44,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answer To calculate Suscos taxable income and determine if there are any carrybacks or carryovers we ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

In problem 66 above, what would be Susco's taxable income if the long-term capital gain were \(\$ 70,000\) (instead of \(\$ 40,000\) )? problem 66 Susco had the following items this year: What is...

-

Susco had the following items this year: What is Susco's taxable income and does it have any carrybacks/carryovers? Gross receipts Operating expenses Long-term capital gain Long-term capital loss...

-

Susco had the following items this year: Gross receipts $700,000 Operating expenses 500,000 Long-term capital gain 40,000 Long-term capital loss (20,000) Short-term capital gain 16,000 Short-term...

-

Assume that n is a positive integer. For each of the following algorithm segments, how many times will the innermost loop be iterated when the algorithm segment is implemented and run? 1) for k:=1 to...

-

What is the effect on the accounting equation where new shares are issued for cash?

-

A particle's acceleration along an x axis is a = 5.0t, with t in seconds and a in meters per second squared. At t = 2.0 s, its velocity is + 17m/s. What is its velocity at t = 4.0 s?

-

What are some obstacles in achieving worldwide comparability of financial statements? LO4

-

Neeley Company incurs the following expenditures in purchasing a truck: cash price $30,000, accident insurance $2,000, sales taxes $1,500, motor vehicle license $100, and painting and lettering...

-

Fresh Limited, a manufacturer of toothpaste, was taken to court over alleged defamation charges when the company accused a rival toothpaste manufacturer of fraud. Before yearend ( 3 1 December 2 0 2...

-

Caskets Inc. was incorporated on June 1, but did not start business until September 1. It adopted a fiscal year ending March 31, coinciding with the end of its natural business cycle. In connection...

-

Bevin Inc. had the following in 2019: a. What is Bevin Inc.s taxable income in 2019? b. What carrybacks or carryovers does it have from 2019? Gross income from operation Dividends from 22%-owned...

-

Read and comment on the survey paper Improving Human Decision Making through Case-Based Decision Aiding by Janet Kolodner (1991).

-

As a project manager it is important to utilize the right tool at the right time. When it comes to managing quality on projects, this is no exception. Identify three 'Total Quality Tools' that you...

-

Describe 2 change models that you could use to create change in an organization. Choose 1 of the models that you think would be most successful in an organization, and analyze reasons why you chose...

-

During the current year, Rothchild, Inc., purchased two assets that are described as follows. Heavy Equipment Purchase price, $375,000. Expected to be used for 10 years, with a residual value at the...

-

Regarding the Mozilla case, assume that Communities of Practice start to arise spontaneously around topics that are related to the visualizations in the Portal at Mozilla. What do you think is the...

-

Regarding Issues That Affect Recruitment, how would you proceed as the assistant superintendent for human resources in a school district that is experiencing a shortage of qualified applicants for...

-

You've been hired by Creative Accountants, economic consultants. Your assignment is to make suggestions about how to structure a government's accounts so that the current deficit looks as small as...

-

Baxter, Inc., owns 90 percent of Wisconsin, Inc., and 20 percent of Cleveland Company. Wisconsin, in turn, holds 60 percent of Clevelands outstanding stock. No excess amortization resulted from these...

-

Consult the case Estate of Edward S. Redstone, 145 T.C. No. 11 (2016), a rather complicated case, and answer the following uncomplicated questions: a. When did the alleged gift occur, and when did...

-

On August 3, 2014 Ginger Grayson, a widow, transferred $55,000 to each of two Sec. 529 plans (qualified tuition programs), one for grandson Greg Grayson and one for granddaughter Gayle Grayson. Her...

-

What was the Sec. 7520 rate for May, June, and July 2016?

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App