Bevin Inc. had the following in 2019: a. What is Bevin Inc.s taxable income in 2019? b.

Question:

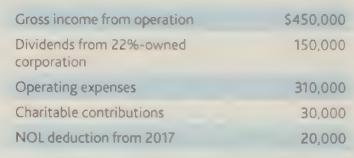

Bevin Inc. had the following in 2019:

a. What is Bevin Inc.’s taxable income in 2019?

b. What carrybacks or carryovers does it have from 2019?

Transcribed Image Text:

Gross income from operation Dividends from 22%-owned corporation Operating expenses Charitable contributions NOL deduction from 2017 $450,000 150,000 310,000 30,000 20,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

To calculate Bevin Incs taxable income in 2019 and determine any carrybacks or carryovers we need to ...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Bevin Inc. had the following in 2018 : a. What is Bevin Inc.'s taxable income in 2018? b. What carrybacks or carryovers does it have from 2018? Gross income from operation Dividends from 22%-owned...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335. Carol is an Associate Professor of Accounting at a local...

-

Suggest two strategies for the company to minimise the impact of the strike on business operation?

-

What is the definition of ownership interest?

-

Figure shows a simple device for measuring your reaction time. It consists of a cardboard strip marked with a scale and two large dots. A friend holds the strip vertically, with thumb and forefinger...

-

What factors contribute to the diversity of accounting systems worldwide? LO4

-

Willard Company manufactures three different sizes of automobile sunscreens: large, medium, and small. Willard expects to incur $360,000 of overhead costs during the next fiscal year. Other budget...

-

Step 1: Analyze transactions: I Step 2: Journalize: Step 3: Step 4: Prepare unadjusted trial balance: . Step 5: Adjust: Step 6: Prepare adjusted trial balance: Step 7: Prepare statements: Step 8:...

-

Susco had the following items this year: What is Suscos taxable income and does it have any carrybacks/carryovers? Gross receipts Operating expenses Long-term capital gain Long-term capital loss...

-

McIntyre Corporation purchases 1,000 shares of a 10 percent owned domestic corporation at $100 per share. McIntyre receives a $25. per share dividend within the first year after the purchase. What is...

-

Europa Associates prepares architectural drawings to conform to local structural-safety codes. Its income statement for 2020 is as follows: The percentage of time spent by professional staff on...

-

reflective account of your development as a postgraduate learner since joining SBS considering the points below. Critically reflect on one or more points below: Assessment Criteria Use a reflective...

-

Technology, strategy, size, and environment are among the factors that influence leaders' choice of organization structure (Schulman, 2020). The leaders must consider the technology to be used in the...

-

6. Answer the following briefly. a.What is the metric and its hurdle rate for an "Enterprise" to increase its enterprise value? b.What is the metric and its hurdle rate for the corporation's equity...

-

Name the two major preceding management theories that contributed to the development of quality management theory. Briefly explain the major concepts of each of these preceding theories that were...

-

922-19x 8 After finding the partial fraction decomposition. (22 + 4)(x-4) dx = dz Notice you are NOT antidifferentiating...just give the decomposition. x+6 Integrate -dx. x33x The partial fraction...

-

"The debt should be of concern." What additional information do you need to undertake a reasonable discussion of this statement?

-

The executor of Gina Purcells estate has recorded the following information: Assets discovered at death (at fair value): Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

Explain to an executor an advantage and a disadvantage of electing the alternate valuation date.

-

Determine the accuracy of the following statement: The gross estate includes a general power of appointment possessed by the decedent only if the decedent exercised the power.

-

Refer to Problem C:13-24. Explain the negative tax considerations (if any) with respect to Balas making gifts of the assets that you recommended. In problem C: 13-24 Bala desires to freeze the value...

-

Yard Professionals Incorporated experienced the following events in Year 1, its first year of operation: Performed services for $31,000 cash. Purchased $7,800 of supplies on account. A physical count...

-

This question is from case # 24 of book Gapenski's Cases in Healthcare Finance, Sixth Edition Select five financial and five operating Key Performance Indicators (KPIs) to be presented at future...

-

assume that we have only two following risk assets (stock 1&2) in the market. stock 1 - E(r) = 20%, std 20% stock 2- E(r) = 10%, std 20% the correlation coefficient between stock 1 and 2 is 0. and...

Study smarter with the SolutionInn App