Bevin Inc. had the following in 2018 : a. What is Bevin Inc.'s taxable income in 2018?

Question:

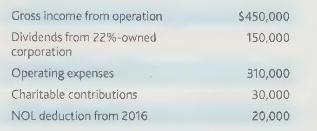

Bevin Inc. had the following in 2018 :

a. What is Bevin Inc.'s taxable income in 2018?

b. What carrybacks or carryovers does it have from 2018?

Transcribed Image Text:

Gross income from operation Dividends from 22%-owned corporation Operating expenses Charitable contributions NOL deduction from 2016 $450,000 150,000 310,000 30,000 20,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

To calculate Bevin Incs taxable income in 2018 we need to follow these steps a Determine Bevin Incs ...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted:

Students also viewed these Business questions

-

Bevin Inc. had the following in 2019: a. What is Bevin Inc.s taxable income in 2019? b. What carrybacks or carryovers does it have from 2019? Gross income from operation Dividends from 22%-owned...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335. Carol is an Associate Professor of Accounting at a local...

-

Answer the following questions. a. Office Store has assets equal to $123,000 and liabilities equal to $47,000 at year-end. What is the total equity for Office Store at year-end? b. At the beginning...

-

What requirements must be satisfied in order to construct a confidence interval about a population mean?

-

Air at 320 K with a free stream velocity of 10 m/s is used to cool small electronic devices mounted on a printed circuit board as shown in the sketch below. Each device is 5 mm 5 mm square in...

-

How can you track the progress of your change management plan? AppendixLO1

-

A local finance company quotes a 17 percent interest rate on one-year loans. So, if you borrow $25,000, the interest for the year will be $4,250. Because you must repay a total of $29,250 in one...

-

Select as many as needed. Debating if issuing shares should be selected Which of the following will lower the retained earnings account? Select ALL correct answers. Generating loss Paying dividends...

-

Susco had the following items this year: What is Susco's taxable income and does it have any carrybacks/carryovers? Gross receipts Operating expenses Long-term capital gain Long-term capital loss...

-

McIntyre Corporation purchases 1,000 shares of a 10 percent owned domestic corporation at \(\$ 100\) per share. McIntyre receives a \(\$ 25\) per share dividend within the first year after the...

-

The following information relates to Sinclair Industries for fiscal 2017, the company's first year of operation: Units produced ..........................................500,000 Units sold...

-

Solve these question in details and fully explaination. It is the pre-lab working for Capacitors. Thanks so much in advance. 1: The figure shows a circuit with a charged capacitor (left), two...

-

Exercise 10-14A (Algo) Straight-line amortization of a bond discount LO 10-4 Diaz Company issued bonds with a $112,000 face value on January 1, Year 1. The bonds had a 8 percent stated rate of...

-

1. What would we have to plot on the vertical axis? EXPLAIN YOUR ANSWER OR NO CREDIT. [Hint: Solve for k first.] F= Kx kx dala you Experi determine the K= K = F Cart SHOW ALL WORK OR NO CREDITI 2....

-

You are interested in computing the heat transfer properties of a new insulation system shown here. Tair Air Layer 1 Layer 2 T P

-

16.3 The demand function for replicas for the Statue of Liberty is given by f(p): = 500 - 2p, where f(p) is the number of statues that can be sold for p dollars. (a) What is the relative rate of...

-

This case offers students the opportunity to develop and analyze strategic alternatives to IndyCars weaknesses relative to NASCAR. A concept that can be emphasized in this case is positioning....

-

Using thermodynamic data from Appendix 4, calculate G at 258C for the process: 2SO 2 (g) + O 2 (g) 88n 2SO 3 (g) where all gases are at 1.00 atm pressure. Also calculate DG8 at 258C for this same...

-

When the built-in gains tax is imposed on an S corporation, how is the tax passed through to the shareholders?

-

When may an S corporation be subject to the built-in gains tax?

-

Under what circumstances may an S corporation switch to a tax year ending on December 31?

-

Javier is currently paying $1,200 in interest on his credit cards annually. If, instead of paying interest, he saved this amount every year, how much would he accumulate in a tax-deferred account...

-

Your company is considering the purchase of a fleet of cars for $195,000. It can borrow at 6%. The cars will be used for four years. At the end of four years they will be worthless. You call a...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

Study smarter with the SolutionInn App