Anita, a single taxpayer, reports the following items for 2022: a. What is the amount of Anitas

Question:

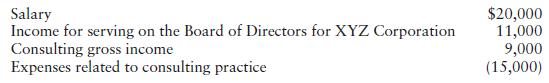

Anita, a single taxpayer, reports the following items for 2022:

a. What is the amount of Anita’s self-employment tax?

b. How would your answer to Part a change if Anita’s salary were $160,000?

Transcribed Image Text:

Salary Income for serving on the Board of Directors for XYZ Corporation Consulting gross income Expenses related to consulting practice $20,000 11,000 9,000 (15,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (20 reviews)

a Taxpayers may deduct losses from selfemployment activitie...View the full answer

Answered By

Sultan Ghulam Dastgir

The following are details of my Areas of Effectiveness English Language Proficiency, Organization Behavior , consumer Behavior and Marketing, Communication, Applied Statistics, Research Methods , Cognitive & Affective Processes, Cognitive & Affective Processes, Data Analysis in Research, Human Resources Management ,Research Project,

Social Psychology, Personality Psychology, Introduction to Applied Areas of Psychology,

Behavioral Neurosdence , Historical and Contemporary Issues in Psychology, Measurement in Psychology, experimental Psychology,

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted:

Students also viewed these Business questions

-

How would your answer to Test Yourself Question 1 differ if the reserve ratio were 25 percent? If the reserve ratio were 100 percent?

-

How would your answer to the Problem 16 be different if the employer in question sold his product according to the demand schedule P = 20 - Q?

-

How would your answer to BE17- 20 change if year 1 income were equal to $ 100,000? Income (Loss) Year Before Tax $300,000 200,000 450,000) Tax Rate 40% 35% 35%

-

Calculate the IRR for the following projects. a. An initial outflow of $15,220 followed by inflows of $5,000, $6,000, and $6,500. b. An initial outflow of $47,104 followed by inflows of $16,000,...

-

Examine the three samples listed here. Without per-forming any calculations, indicate which sample has the largest amount of variation and which sample has the smallest amount of variation. Explain...

-

In groups, compare and contrast your likely responses to the three scenarios. Come to a consensus on the two most likely responses for the group as a whole. Elect one group member to write the two...

-

Purchase of office furniture 12,000 has been debited to general expenses account. It is (a) A clerical error (b) An error of principle (c) An error of omission

-

The accounts of Spa View Service, Inc., at March 31, 2010, are listed in alphabetical order. Requirements 1. All adjustments have been journalized and posted, but the closing entries have not yet...

-

Sam expects to get $3,000 dollars per year for 16 years; what is the present value of this if the annual interest is 6.1 percent

-

In each of the following exercises, the assignment is to prepare an office memo. Each assignment contains an assignment memo from the supervising attorney that includes all the available facts of the...

-

In each of the following independent situations, determine the amount of the child and dependent care tax credit. (Assume that both taxpayers are employed and the year is 2022.) a. Brad and Bonnie...

-

Arnie and Angela are married and file a joint return in 2022. Arnie is a partner in a public accounting firm. His share of the partnerships income in the current year is $40,000, and he receives...

-

The demand function for a certain product is q = -300p + 10,000. The fixed expenses are $500,000 and the variable expenses are $2 per item produced. a. Express the expense function in terms of q. b....

-

As shown on the attached chart, what is the approximate current 7-year spread premium for Kellogg Bonds? 25 Basis Points 75 Basis Points 200 Basis Points AUS Treasury Actives Curve X-ads Tenor...

-

A pharmaceutical company claims to have invented a new pill to aid weight loss. They claim that people taking these pills will lose more weight than people not taking them. A total of twenty people...

-

Let U = {a, b, c, d, e, f} be the universal set and let A = {a, b, c, d, e, f}. Write the set A. Remember to use correct set notation. Provide your answer below: A=

-

Produce a poster series of three (3) A3 sized posters on creativity in the early years. As a collective the poster series must articulate the importance of aesthetics and creativity for young...

-

Find the second derivative of the function. g(x) = ex In(x) g"(x) = Need Help? Read It

-

What is the default risk premium, and why did it dramatically increase during the 20072009 recession? How did this increase affect the MP curve and the output gap?

-

An interest bearing promissory note for 90 days at 5.6% p.a. has a face value of $120,000. If the note is discounted 20 days after the issue date at a rate of 6.8% p.a., calculate the amount of...

-

Discuss the idea of drawing separate demand curves for different market segments. It seems logical because each target market should have its own marketing mix. But wont this lead to many demand...

-

Distinguish between leader pricing and bait pricing. What do they have in common? How can their use affect a marketing mix?

-

Cite a local example of psychological pricing and evaluate whether it makes sense.

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App