At the close of business on May 31, 2022, Alaska Corporation exchanges $2 million of its voting

Question:

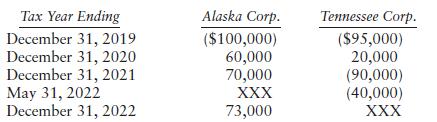

At the close of business on May 31, 2022, Alaska Corporation exchanges $2 million of its voting common stock for all the noncash assets of Tennessee Corporation. Tennessee uses its cash to pay off its liabilities and then liquidates. Tennessee and Alaska report the following taxable income (loss):

a. What tax returns must Alaska and Tennessee file for 2022?

b. What amount of the NOL carryover does Alaska acquire?

c. Ignoring Sec. 382 limitations, what amount of Tennessee’s NOL can Alaska use in 2022? What is Alaska’s NOL carryover to 2023?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted: