On Form W-4, Virginia decided to request her employer withhold more taxes than she generally would have

Question:

On Form W-4, Virginia decided to request her employer withhold more taxes than she generally would have withheld.

a. Is it permissible to request greater withholdings than an individual is entitled to?

b. Why would an individual request additional withholdings?

c. Is it possible for Virginia to request lower withholdings?

Transcribed Image Text:

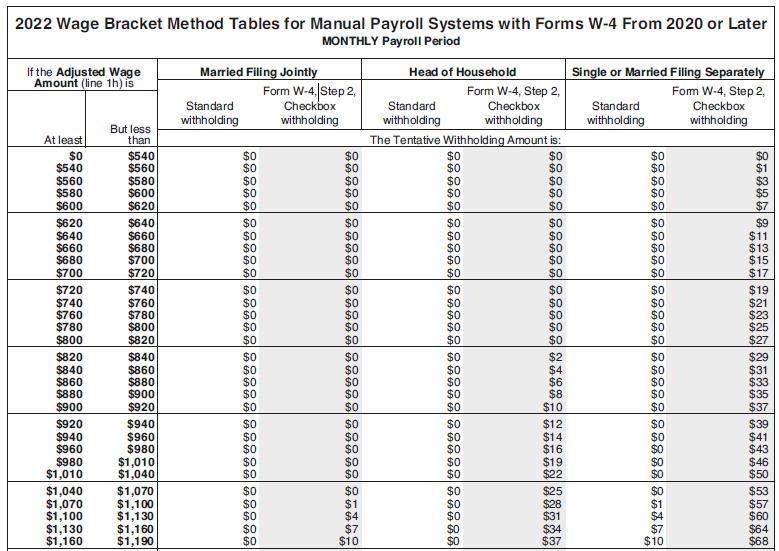

2022 Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 From 2020 or Later MONTHLY Payroll Period If the Adjusted Wage Amount (line 1h) is At least $0 $540 $560 $580 $600 $620 $640 $660 $680 $700 $720 $740 $760 $780 $800 $820 $840 $860 $880 $900 $920 $940 $960 $980 $1,010 $1,040 $1,070 $1,100 $1,130 $1,160 But less than $540 $560 $580 $600 $620 $640 $660 $680 $700 $720 $740 $760 $780 $800 $820 $840 $860 $880 $900 $920 $940 $9 $980 $1,010 $1,040 $1,070 $1,100 $1,130 $1,160 $1,190 Married Filing Jointly Standard withholding $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Form W-4, Step 2, Checkbox withholding $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $1 $4 $7 $10 Head of Household Standard withholding The Tentative Withholding Amount is: $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Form W-4, Step 2, Checkbox withholding $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $2 $4 $6 680 $8 $10 $12 14 $16 69 69 6 $19 $22 $25 $28 $31 $34 $37 Single or Married Filing Separately For W-4, Step 2, Checkbox withholding Standard withholding $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $7 $10 $9 $11 $13 $15 $17 $19 $21 $23 $25 $27 $29 $31 $33 $35 $37 $39 $43 $46 $50 $53 $57 $60 $64 $68

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

a Yes a person may request greater withholdings on Form W...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted:

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

In Problems 1118, mentally solve each equation. 6x = -24

-

Comment on the following statement: while engagement letters are useful for audit engagements, they are not necessary for compilation and review engagements.

-

As an HR specialist in hospitality, what would you advise Ms. Goh to do in the future? What would you advise Ms. Hidalgo to do now?

-

4. Exhibit 18.11 presents deferred-tax assets and liabilities for ToyCo. Using Exhibit 18.8 as a guide, reorganize the deferred-tax table into two categories: net operating deferred-tax assets (net...

-

Holmes Company reported the following balance sheets at December 31, 2017 and 2018: Its income statement for 2018 was as follows: ($ in millions)...

-

Question 22 (1 point) When a developer builds a building on a previously vacant lot the developer is creating what form of real estate? Improvement on the land Improvement to the land Intangible Land

-

Bart and Jane Lee are married, file a joint return and have one dependent child (age 9). Bart begins a new job and is asked to fill out a Form W-4. What are the important pieces of information that...

-

Using the central bank balance sheet diagrams, evaluate how each of the following shocks affects a countrys ability to defend a fixed exchange rate. In the following answers, we assume the central...

-

Kennedy Company has the following portfolio of trading investments at December 31, 2010. On December 31, 2011, Kennedys portfolio of equity investments consisted of the following investments. At the...

-

Share your thoughts on the descriptions of coaching versus mentoring. Discuss which technique you personally find more helpful, incorporating your peers' example scenarios if possible. Provide...

-

Hanung Corp has two service departments, Maintenance and Personnel. Maintenance Department costs of $380,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of...

-

Discuss difference between nominal interest rate and real interest rate. Explain why real interest rate is more important than the nominal interest rate using your answer to Question 1 of the...

-

Refer to Figure 14-1. How would an increase in the money supply move the economy in the short and long run?

-

1) Special Relativity. Statement: Imagine this situation: Alice stands in New York City while Bob, aboard a plane departing from Boston, directly crosses over Alice at t=0. Disregard the vertical...

-

The textbook model assumes that individuals have enough knowledge to follow the economic decision rule. a. How did you decide what college you would attend? b. Did you have enough knowledge to follow...

-

Review Exhibit 11.4. Analyze each product on the graph according to the characteristics that influence the rate of adoption. For example, what can you conclude from the data about the relative...

-

What business benefits did the companies and services described in this case achieve by analyzing and using big data.

-

Identify two decisions at the organizations described in this case that were improved by using big data, and two decisions that were not improved by using big data.

-

List and describe the limitations to using big data.

-

Flexible manufacturing places new demands on the management accounting information system and how performance is evaluated. In response, a company should a. institute practices that reduce switching...

-

Revenue and expense items and components of other comprehensive income can be reported in the statement of shareholders' equity using: U.S. GAAP. IFRS. Both U.S. GAAP and IFRS. Neither U.S. GAAP nor...

-

Kirk and Spock formed the Enterprise Company in 2010 as equal owners. Kirk contributed land held an investment ($50,000 basis; $100,000 FMV), and Spock contributed $100,000 cash. The land was used in...

Study smarter with the SolutionInn App