Tampa Corporation sold the following assets in 2022: a. What is the depreciation deduction for each asset

Question:

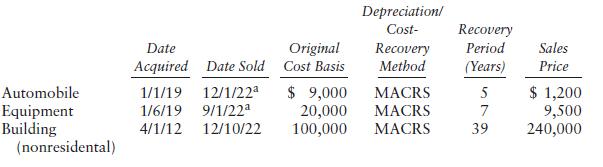

Tampa Corporation sold the following assets in 2022:

a. What is the depreciation deduction for each asset in 2022?

b. Compute the gain or loss on each asset sold.

Transcribed Image Text:

Automobile Equipment Building (nonresidental) Date Acquired Original Date Sold Cost Basis 1/1/19 12/1/22a $ 9,000 1/6/19 9/1/22ª 20,000 4/1/12 12/10/22 100,000 Depreciation/ Cost- Recovery Method MACRS MACRS MACRS Recovery Period (Years) 5 7 39 Sales Price $ 1,200 9,500 240,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

a Depreciation for 2022is computed as follows Automobile 9000 x 01152 x 12 Table 1 Yea...View the full answer

Answered By

Surojit Das

I have vast knowledge in the field of Mathematics, Business Management and Marketing. Besides, I have been teaching on the topics Management leadership, Business Administration, Human Resource Management, Business Communication, Accounting, Auditing, Organizer Behaviours, Business Writing, Essay Writing, Copy Writing, Blog Writing since 2020. It is my personality to act quickly in any emergency situations when students need my services. I am very professional and serious in every questions students asked me at the time of dealing any projects. I have been serving detailed, quality, properly analysed research paper through the years.

4.80+

91+ Reviews

279+ Question Solved

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted:

Students also viewed these Business questions

-

Tampa Corporation sold the following assets in 2015: a. What is the depreciation deduction for each asset in 2015? b. Compute the gain or loss on each asset sold. Date Date Original Cost...

-

Tampa Corporation sold the following assets in 2012: a. What is the depreciation deduction for each asset in 2013? b. Compute the gain or loss on each asset sold. OriginalDepreciation Recovery Date...

-

Tampa Corporation sold the following assets in 2019: a. What is the depreciation deduction for each asset in 2019? b. Compute the gain or loss on each asset sold. Automobile Equipment Building...

-

The death of Steve Jobs in 2011 sent the world into mourning for the loss of a great innovator. No longer would the world witness Apples enthusiastic CEO clad in his characteristic black turtleneck...

-

Detail the steps for identifying the issue(s) in a client's case.

-

Robert Klassen Manufacturing, a medical equipment manufacturer, subjected 100 heart pacemakers to 5,000 hours of testing. Halfway through the testing, 5 pacemakers failed. What was the failure rate...

-

3. If a new partnership agreement is not established, how will profits and losses be divided? PartnershipsFormation, Operations, and Changes in Ownership Interests 559

-

For seven years, Monaco Corporation has been owned entirely by Stacy and Monique, who are husband and wife. Stacy and Monique have a $165,000 basis in their jointly owned Monaco stock. The Monaco...

-

Greg's Bicycle Shop has the following transactions related to its top - selling Mongoose mountain bike for the month of March. Greg's Bicycle Shop uses a periodic inventory system. For the specific...

-

Prepare general journal entry. Billy Bob's Bikes Transactions Nov. 1: Billy Bob paid in advance for an 8-month insurance policy, which will begin today. He paid $3,856 cash for the policy. Nov, 1-...

-

Prior to 2022, many taxpayers deducted research and experimental (R&E) expenditures when they were paid or incurred. a. Explain how this pre-2022 treatment differs from their deductibility in 2022...

-

On March 1, 2022, Sarah entered into a three-year lease of an automobile used exclusively in her business. The automobiles FMV was $58,500 at the inception of the lease. Sarah made ten monthly lease...

-

Which of the following payroll-related taxes are not withheld from an employee's earnings? a. Medicare taxes b. Income taxes c. Federal unemployment taxes d. Social Security taxes

-

PP Company purchases a material that is then processed to yield three chemicals: anarol, estyl, and betryl.In June, PPC purchased 10,000 gallons of the material at a cost of $250,000, and the company...

-

Suppose Boyson Inc. free cash flow for the next year is $ 1 5 0 , 0 0 0 and the FCF is expected to grow a concert rate of 6 . 5 % if WACC is 1 2 . 5 % what is the market value of the firm?

-

An eight lane urban freeway (four lanes in each direction) is on rolling terrain and has 11-ft lanes with a 4-ft right-side shoulder. The interchange density is 1.25 per mile. The base free-flow...

-

For the following business events, please indicate the increase (+) or decrease (-) on the following income statement and balance sheet categories. If there is no effect, leave the box blank. If...

-

4. Change the magnet to the original orientation and drag through the coil. a. What happens to the voltage and light bulb as the North Pole moves through the coil? b. What happens to the voltage and...

-

Find the exact value of each expression. (a) csc 1 2 (b) arcsin 1

-

Access the Federation of Tax Administrators Internet site at www. taxadmin.org/state-tax-forms and indicate the titles of the following state tax forms and publications: a. Minnesota Form M-100 b....

-

All assets listed below have been held for more than one year. Which assets might be classified as Sec. 1231, Sec. 1245, or Sec. 1250 property? An asset may be classified as more than one type of...

-

The Pear Corporation owns equipment with a $300,000 adjusted basis. The equipment was purchased six years ago for $650,000. If Pear sells the equipment for the selling prices given in the three...

-

Leroy owns a truck used in his trade or business that cost $50,000 and has an adjusted basis of $34,000. The truck is exchanged for a new truck that is like-kind property with a FMV of $40,000. Prior...

-

Fig 1. Rolling a 4 on a D4 A four sided die (D4), shaped like a pyramid (or tetrahedron), has 4 flat surfaces opposite four corner points. A number (1, 2, 3, or 4) appears close to the edge of each...

-

I just need help with question #4 please! Thank you! Windsor Manufacturing uses MRP to schedule its production. Below is the Bill of Material (BOM) for Product A. The quantity needed of the part...

-

(25) Suppose that we have an economy consisting of two farmers, Cornelius and Wheaton, who unsurprisingly farm corn c and wheat w, respectively. Assume that both farmers produce their crop of choice...

Study smarter with the SolutionInn App