Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $1.7

Question:

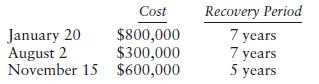

Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $1.7 million of depreciable property during 2022:

You are working in Woburn’s tax department and are trying to decide how to make the Sec. 179 election so as to maximize Woburn’s 2022 depreciation deduction. What tax issues should you consider for this decision?

Transcribed Image Text:

January 20 August 2 November 15 Cost $800,000 $300,000 $600,000 Recovery Period 7 years 7 years 5 years

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 78% (14 reviews)

If Woburn does not elect Sec 179 expensing and elects out of bonus depreciation the principal issue to consider is the applicability of the midquarter ...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted:

Students also viewed these Business questions

-

Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $1.7 million of depreciable property during 2019: You are working in Woburn's tax department and...

-

Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $850,000 of depreciable property during 2016: You are working in Woburn's tax department and are...

-

Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $850,000 of depreciable property during 2017: _________________________ Cost Recovery...

-

Consider the case of the Cisco Fatty. Who was wrong? Advise how a firm might best handle this kind of online commentary.

-

Correct the following citation: Hoang Nguyen v. Fasano 84 F. Supp.2d 1099,(S.D.Cal.2000).

-

an increase in wages that is designed to match increases in the prices of items purchased by the typical household Match each term with its correct definition by placing the appropriate letter next...

-

P 16-3 Partnership income allocation Ash and Bar are partners with capital balances on January 1, 2016, of $70,000 and $80,000, respectively. The partnership agreement provides that each partner is...

-

Massa Company, which has been operating for three years, provides marketing consulting services worldwide for dot-com companies. You are a financial analyst assigned to report on the Massa management...

-

Why is it important to adjust motivational styles to individual employees

-

When did the rapid development of the management science discipline begin?

-

In 2022, Andes Corporation purchases $1.5 million of machinery (7-year property) and places it into service in its business. What are Andes depreciation deductions for 2022 and 2023 in each of the...

-

Heather and Nikolay Laubert are married and file a joint income tax return. Their address is 3847 Jackdaw Path, Madison, WI 58493. Nikolays Social Security number is 000-00- 1111, and Heathers is...

-

Consider the chromatography of n-C12H26 on a 25-m-long 0.53-mm-diameter open tubular column of 5% phenyl-95% methyl polysiloxane with a stationary-phase thickness of 3.0 m and He carrier gas at...

-

Follows is a list of outstanding invoices at 12/31/09. List is by customer. Company: Winter Invoice: 101 Date: Amount: 4/15 300.00 155 7/1 500.00 162 10/14 600.00 197 12/16 250.00 Bradley 126 6/25...

-

Question 3. The acceleration of a robot as it moves along a straight line in the horizontal x-axis is given by -kt a = e (2 cos wt +3 sin wt), k = 0, w % 0, where k and w are positive constants and...

-

(1 pt) To find the length of the curve defined by from the point (0,0) to the point (1,9), you'd have to compute where a b= and f(x)= y=5x+4x / f(x)dx

-

screen. In Exercises 21 through 32, find the instantaneous rates of change of the given functions at the indicated points. 21. f(x) = 2x + 3, c = 2 22.) f(x) = -3x+4, c = 3 23. f(x) = x - 1, c = 1...

-

Solve . f(x)= cos(x) 2+ sin(x)

-

Find the exact value of each expression. (a) arcsin(sin(5/4)) (b) cos(2 sin 1 (5/13))

-

Write the statement to store the contents of the txtAge control in an Integer variable named intAge.

-

Mike Webb, married to Nancy Webb, is employed by a large pharmaceutical company and earns a salary. In addition, Mike is an entrepreneur and has two small businesses on the side, both of which...

-

Jeff and Linda Foley are married and file a joint income tax return. Jeff is a lawyer and a partner in the firm of Foley & Looby, Attorneys at Law. Jeff is a 50% partner in the firm along with his...

-

Access the Urban Institute and Brookings Institution Tax Policy Center at taxpolicycenter.org. On the home page, search for state individual income tax rates and locate the Tax Policy Centers latest...

-

ABC company makes turbo-encabulators, customized to satisfy each customers order. They split overhead into five pools, each with its own activity driver (direct labor for manufacturing, direct labor...

-

Variable manufacturing overhead becomes part of a unit's cost when variable costing is used.Group of answer choicesTrueFalse

-

Santa Fe Corporation has computed the following unit costs for the year just ended:Direct Material used $23Direct Labor $18Fixed selling and administrative cost $18Variable manufacturing overhead...

Study smarter with the SolutionInn App