At the end of year 6, the tax effects of temporary differences reported in Tortoise Companys year-end

Question:

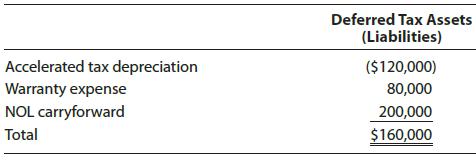

At the end of year 6, the tax effects of temporary differences reported in Tortoise Company’s year-end financial statements were as follows.

A valuation allowance was not considered necessary. Tortoise anticipates that $40,000 of the deferred tax liability will reverse in year 7, that actual warranty costs will be incurred evenly in year 8 and year 9, and that the NOL carryforward will be used in year 7. On Tortoise’s December 31, year 6 balance sheet, what amount should be reported as a deferred tax asset under U.S. GAAP?

a. $160,000

b. $200,000

c. $240,000

d. $280,000

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2020 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357109175

23rd Edition

Authors: Annette Nellen, James C. Young, William A. Raabe, David M. Maloney

Question Posted: