Parker and his wife Marie would have been filing a joint tax return for 2016; however, Marie

Question:

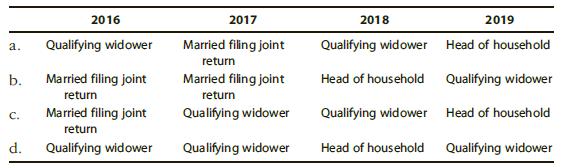

Parker and his wife Marie would have been filing a joint tax return for 2016; however, Marie died in October 2016. Parker has not remarried and continues to maintain a home for himself and his two children from 2016 through 2019. Parker’s filing statuses for those tax years are as follows.

Transcribed Image Text:

2016 2017 2018 2019 Qualifying widower Married filing joint Qualifying widower Head of household a. return b. Married filing joint Married filing joint Head of household Qualifying widower return return Married filing joint Qualifying widower Qualifying widower Head of household C. return d. Qualifying widower Qualifying widower Head of household Qualifying widower

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

ANSWER Based on the provided information Parkers filing statuses for th...View the full answer

Answered By

Surendar Kumaradevan

I have worked with both teachers and students to offer specialized help with everything from grammar and vocabulary to challenging problem-solving in a range of academic disciplines. For each student's specific needs, I can offer explanations, examples, and practice tasks that will help them better understand complex ideas and develop their skills.

I employ a range of techniques and resources in my engaged, interesting tutoring sessions to keep students motivated and on task. I have the tools necessary to offer students the support and direction they require in order to achieve, whether they need assistance with their homework, test preparation, or simply want to hone their skills in a particular subject area.

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

A married couple is filing a joint tax return and claiming their three children as dependents, ages 12,14, and 17. They have an AGI of $190,900 this year. Determine the amount of child tax credit...

-

In 2020, Juanita is married and files a joint tax return with her husband. What is her tentative minimum tax in each of the following alternative circumstances? a. Her AMT base is $100,000, all...

-

Robert and Mary file a joint tax return for 2015 with adjusted gross income of $34,000. Robert and Mary earned income of $20,000 and $14,000, respectively, during 2015. In order for Mary to be...

-

Provide an detailed overview on the topic indirect pay/benefits. Use the information given: Indirect Pay: any type of employer-provided reward (or "benefit") that serves an employee need but is not...

-

Using the given functions, find the limits by plugging in (if possible). Say whether the limit is infinity or negative infinity. Compute the value of the function 0.1 and 0.01 above and below the...

-

LO1 Susan is single with a gross income of $110,000 and a taxable income of $88,000. In calculating gross income, she properly excluded $10,000 of tax-exempt interest income. Using the tax rate...

-

20. Consider again the Netscape PEPS discussed in this chapter and assume the following: the price of Netscape is $39.25, Netscape is not expected to pay dividends, the interest rate is 7%, and the...

-

Xellnet provides e- commerce software for the pharmaceuticals industry. Xellnet is orga-nized into several divisions. A companywide planning committee sets general strategy and goals for the company...

-

PROBLEM 6. (11 points) Effects of Accounting Events: PART A. (9 points) Show the dollar effects on assets, liabilities and/or owners' equity of these independent transactions/events. Put the dollar...

-

GGG Electronics builds short-wave radios. Its manufacturing plant is also a warehouse. When parts are received, the receiver compares the type of goods and quantity to a copy of the purchase order...

-

Wesley and Myrtle (ages 90 and 88, respectively) live in an assisted care facility and for the last two years received their support from the following sources. Percentage of Support Social Security...

-

Kyle and Elena Smith contributed to the support of their two children, Alexandra and Matthew, and Elenas divorced father Nick. This year, Alexandra, age 22 and a full-time college student, earned...

-

Describe operating profit margin and asset turnover, and explain how each of these ratios can be used to help division managers improve ROI.

-

How do cognitive biases such as confirmation bias, anchoring, and the availability heuristic influence the quality of decision-making within complex organizational contexts ?

-

What role do cognitive biases, such as confirmation bias and anchoring, play in perpetuating conflict, and how can awareness of these biases facilitate more effective conflict resolution strategies?

-

Were you surprised by the results? Do you agree with the results? How can you use this knowledge of your personal biases to inform your management strategies? How can the identified biases impact...

-

what ways do existing power structures perpetuate social stratification, and what are the socio-political ramifications of these dynamics ?

-

How do feedback loops and reflective practices contribute to continuous improvement and the refinement of teamwork dynamics over time ? Explain

-

Write a method called doubleList that doubles the size of a list by appending a copy of the original sequence to the end of the list. For example, if the list stores [1, 8, 2, 7], your method should...

-

On January 2, 20X3, Sheldon Bass, a professional engineer, moved from Calgary to Edmonton to commence employment with Acco Ltd., a large public corporation. Because of his new employment contract,...

-

Olivia, a calendar year taxpayer, does not file her 2019 Form 1040 until December 12, 2020. At this point, she pays the $40,000 balance due on her 2019 tax liability of $70,000. Olivia did not apply...

-

Maureen, a calendar year individual taxpayer, files her 2018 return on November 4, 2020. She did not obtain an extension for filing her return, and the return reflects additional income tax due of...

-

Kold Services Corporation estimates that its 2019 taxable income will be $500,000. Thus, it is subject to a 21% income tax rate and incurs a $105,000 liability. For each of the following independent...

-

Docs Auto Body has budgeted the costs of the following repair time and parts activities for 2009: Doc's budgets 6,000 hours of repair time in 2009. A profit margin of $7 per labour hour will be added...

-

QUESTION 28 In a perpetual inventory system, the cost of inventory sold is: Debited to accounts receivable. Debited to cost of goods sold. O Not recorded at the time goods are sold. O Credited to...

-

The following financial statements and additional information are reported. IKIBAN INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 $105,709 69,500 66,800 4,700 246,700 127,eee...

Study smarter with the SolutionInn App