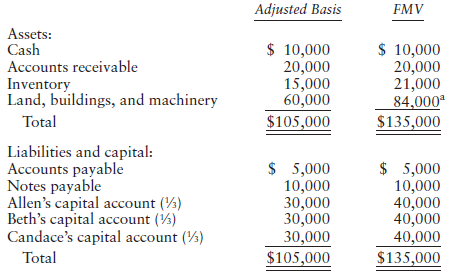

The balance sheet of the ABC Partnership at December 31 of the current year is as follows:

Question:

All partners have an equal interest in the partnership. Allen sells his partnership interest to an outsider on December 31 of the current year for $40,000. Allen€™s basis in the partnership interest is $35,000 (which includes Allen€™s share of partnership liabilities).

a. What amount does Allen realize on the sale?

b. What are the amount and character of Allen€™s recognized gain or loss on the sale?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: