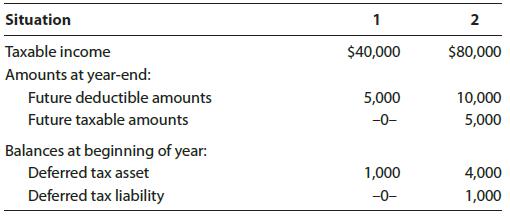

Two independent situations are described below. Each situation has future deductible amounts and/or future taxable amounts produced

Question:

Two independent situations are described below. Each situation has future deductible amounts and/or future taxable amounts produced by temporary differences.

The enacted state and Federal tax rate is 25% for both situations. Determine the income tax expense for the year.

Situation 1 Situation 2

a. $10,000 $20,000

b. $9,000 $21,000

c. $5,000 $17,000

d. $0 $0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2020 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357109175

23rd Edition

Authors: Annette Nellen, James C. Young, William A. Raabe, David M. Maloney

Question Posted: