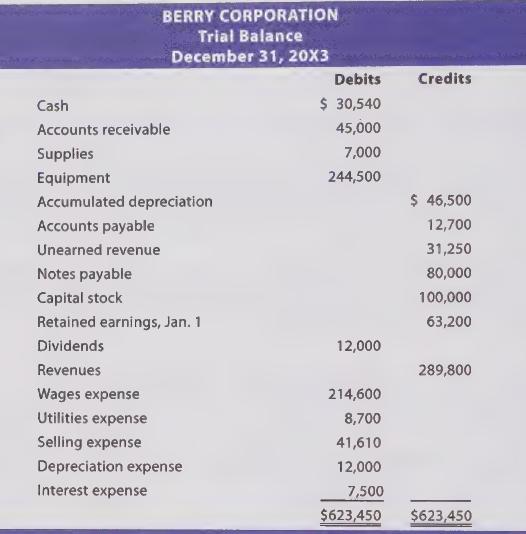

Berry Corporation prepared the following preliminary trial balance. The trial balance and other information was evaluated by

Question:

Berry Corporation prepared the following preliminary trial balance. The trial balance and other information was evaluated by Delton Wiser, CPA. Delton has returned a list of proposed adjustments that are necessary to facilitate preparation of correct financial statements for the year ending December 31, 20X3.

Delton discovered that 40% of the unearned revenue appearing in the trial balance had actually been earned as of the end of the year.

A physical count of supplies on hand revealed a year-end balance of only \($3\),000.

Unpaid and unrecorded invoices for utilities for December amounted to \($1\),500.

The last payday was December 26. Employees are owed an additional \($3\),900 that has not been recorded.

Additional depreciation of \($3\),100 needs to be recorded.

(a) Prepare journal entries relating to the adjustments.

(b) Prepare an adjusted trial balance.

(c) Prepare an income statement and statement of retained earnings for 20X3, and a classified balance sheet as of the end of the year.

(d) Berry's bookkeeper argued with Delton that there was no need to record the adjustments since they have no "net" effect on income. Evaluate whether this observation is true of false, and comment on the appropriateness of this logic.

Step by Step Answer: