On January 1, 20X7, Jacqueline Fernandez formed a corporation to purchase wheat harvesting equipment and provide contract

Question:

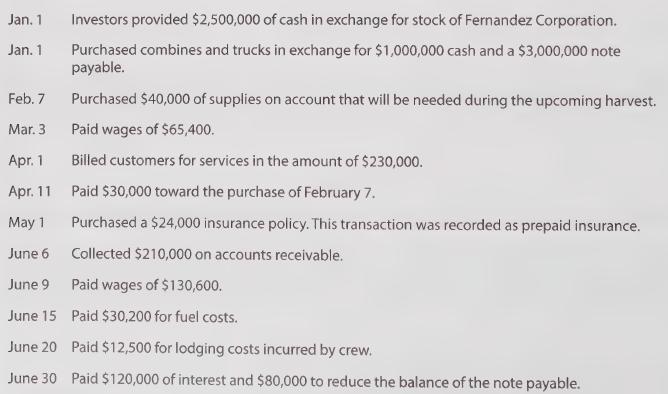

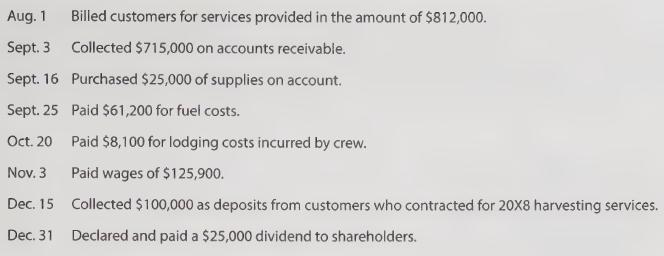

On January 1, 20X7, Jacqueline Fernandez formed a corporation to purchase wheat harvesting equipment and provide contract support services to farmers throughout the Midwest. Information about the first year of operation follows:

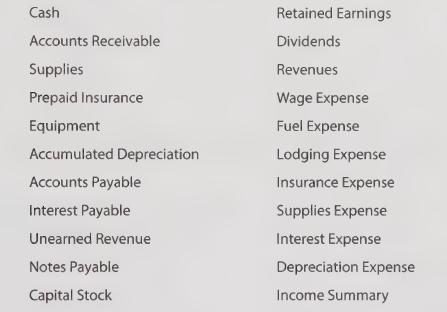

Fernandez Corporation uses the following accounts:

(a) Journalize the listed transactions.

(b) Post the transactions to the appropriate general ledger accounts.

(c) Prepare a trial balance as of December 31.

(d) Journalize and post adjusting entries based on the following additional information.

The equipment had 25- year life, with no salvage value.

Supplies on hand at year end amount to $20,000.

At year end, $115,000 of additional interest is due on the note payable.

The insurance policy covered a 12-month period commencing on May 1.

At year end, Fernandez had provided $30,000 of unbilled services to customers. These services will be billed in early 20X8.

(e) Prepare an adjusted trial balance as of December 31.

(f) Prepare an income statement and statement of retained earnings for 20X7, and a classified balance

(g) sheet as of the end of the year.

(h) Journalize and post closing entries.

(i) Prepare a post-closing trial balance as of December 31.

Step by Step Answer: