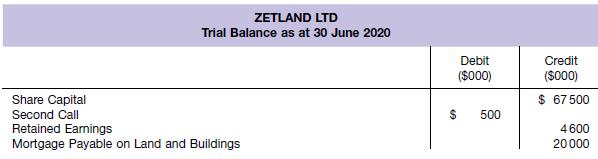

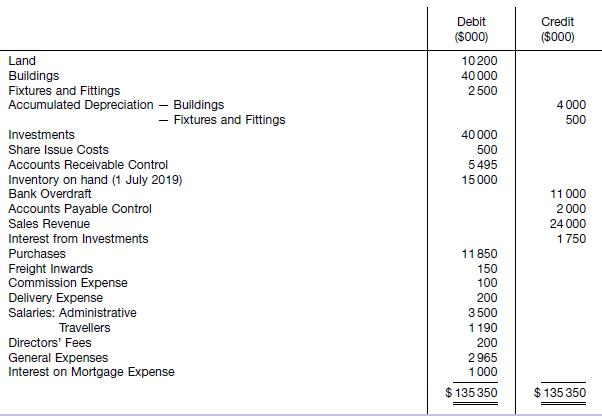

The accounts in the ledger of Zetland Ltd as at 30 June 2020 had balances as shown

Question:

The accounts in the ledger of Zetland Ltd as at 30 June 2020 had balances as shown below.

The Share Capital account represents 30 000 000 shares fully paid at $1 and 50 000 000 shares issued at $1 but called to 75c per share. A call of 25c per share had been made on these 50 000 000 shares during the year, but 2 000 000 had failed to pay the call by 30 June 2020. An interim dividend of $1 500 000 has been paid during the year out of retained earnings.

Inventory on hand at 30 June 2020 was $16 000 000.

The following adjustments have to be made.

1. Provide for 10% p.a. depreciation on cost of fixtures and fittings and 5% p.a. on buildings for the whole year

2. Unrecorded and unpaid expenses: travellers’ salaries $100 000

3. General expenses prepaid, $15 000

4. Record income tax expense and current tax liability of $900 000

5. Declare a final dividend, $1 500 000; no ratification of this dividend is needed

6. Share issue costs to be written off against share capital

7. An amount of $1 000 000 is to be transferred to a general reserve from retained earnings.

Required

Prepare an income statement for the year ended 30 June 2020, and a balance sheet as at 30 June 2020.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield