Although downsized in recent years, General Electric is still a large, diversified company. Outlined below are current

Question:

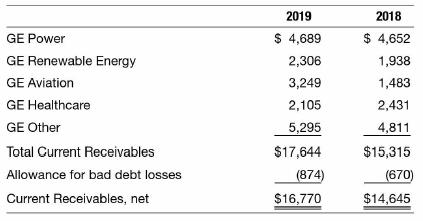

Although downsized in recent years, General Electric is still a large, diversified company. Outlined below are current accounts receivable by operating division, as reported in the company's 2019 annual report (in millions):

The increase in receivables occurred despite the fact that the company's revenues declined from 2018 to 2019. This slowdown in the collection of receivables was driven, in part, by GE's Aviation group and its relationship with the manufacturer of the troubled 737 MAX jetliner, Boeing. The 2019 annual report indicates that the "increase in Aviation segment is primarily driven by receivables from Boeing due to the 737 MAX temporary fleet grounding, with balance of $1,397 million as of December 31, 2019 ."

a. Which industrial area of GE appears to be the largest?

b. Compute the allowance for bad debt losses as a percentage of gross receivables. Should you use the consolidated receivables or receivables for one of the units? Why? Compute the percent of Aviation receivables due from Boeing. What concerns do you note?

c. If Boeing continues to have problems with its 737 MAX airplane, how might that affect GE's financial statements? If Boeing's customers (specifically, commercial airlines) have financial problems due to travel bans for pandemic health problems, how might that affect GE's statements?

Step by Step Answer: