The net income reported on the income statement for the current year was $73,600. Depreciation recorded on

Question:

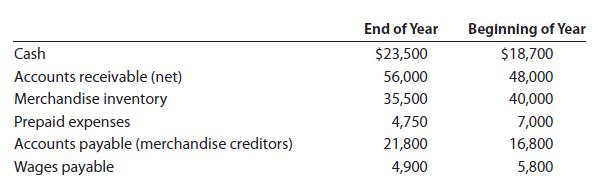

The net income reported on the income statement for the current year was $73,600. Depreciation recorded on store equipment for the year amounted to $27,400. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows:

a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method.

b. Briefly explain why net cash flows from operating activities is different from net income.

End of Year Beginning of Year Cash $23,500 $18,700 Accounts receivable (net) 56,000 48,000 Merchandise inventory 35,500 40,000 Prepaid expenses Accounts payable (merchandise creditors) 4,750 7,000 21,800 16,800 Wages payable 4,900 5,800

Step by Step Answer:

a Cash flows from Operating Activities Net Income 73600 Ad...View the full answer

Financial Accounting

ISBN: 9781337913102

16th Edition

Authors: Carl S. Warren, Christine Jonick, Jennifer Schneider

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

The net income reported on the income statement for the current year was $378,000. Depreciation recorded on equipment and a building amounted to $112,500 for the year. Balances of the current asset...

-

The net income reported on the income statement for the current year was $290,000. Depreciation recorded on equipment and a building amounted to $150,000 for the year. Balances of the current asset...

-

The net income reported on the income statement for the current year was $720,000. Depreciation recorded on store equipment for the year amounted to $32,700. Balances of the current asset and current...

-

Please research a small business Chagrin Falls Popcorn Shop ( https://www.chagrinfallspopcorn.com/ ) social media, and mobile marketing they have been using, etc). In the final exam, you will put...

-

1. Graphically compare the monopolistic competitors profit maximizing output with the output that would minimize its unit costs of production. 2. Discuss whether excess capacity is good or bad.

-

Should professional accountants push for the development of a comprehensive framework for the reporting of corporate social performance? Why?

-

60. Daisy Taylor has developed a viable new business idea. Her idea is to design and manufacture cookware that remains cool to the touch when in use. She has had several friends try out her prototype...

-

A local restaurant, Freds Fish Fry, is estimating nonfood kitchen costs (labor, supervision, utilities, etc.) based on food cost. Data were gathered for the past 24 months and analyzed using a...

-

When trying to predict customer's overall satisfaction with their discount online broker, we use their satisfaction with the price of a trade and their satisfaction with execution speed as...

-

As T.C. Resort Properties seeks to improve its customer service, the company faces new competition from SunLow Resorts. SunLow has recently opened resort hotels on the islands where T.C. Resort...

-

Paneous Corporations comparative balance sheet for current assets and liabilities was as follows: Adjust net income of $351,000 for changes in operating assets and liabilities to arrive at net cash...

-

Eastlund Corporations accumulated depreciationequipment account increased by $6,320, while $2,450 of patent amortization was recognized between balance sheet dates. There were no purchases or sales...

-

Evaluate the integral. =dx Vx + 1 + Jx

-

What makes a set of objects a vector space? You will no doubt want to refer to notes and the text, but I'd like you to summarize it for starters. If you have identified a vector space, for example...

-

Walla Walla Company is in its planning stage for next year. Walla Walla expects a big Quarter 3 and is creating a production budget to determine if it needs to hire more employees. Walla Walla knows...

-

Task: P9 P9a P9b P9c P9d Describe the principles and applications of electromagnetic induction Describe using a series of bullet point statements, how transformers work and how their operation...

-

Based on the given information, analyse company's financial health and provide future projections. Unit FY16 FY17 FY18 FY19 Sales Rs. Cr 134 245 371 1,159 PAT Rs. Cr (281) (585) (78) (571) Assets Rs....

-

OBJECTIVE QUESTIONS 1. In each of the following only one statement/item is correct. State which. (i) Financial Accounting helps in (a) ascertaining the financial position of the concerned firm, (b)...

-

The financial statements of Columbia Sportswear Company are presented in Appendix B. Financial statements of VF Corporation are presented in Appendix C. Instructions. a. Based on the information...

-

A stock has had returns of 8 percent, 26 percent, 14 percent, 17 percent, 31 percent, and 1 percent over the last six years. What are the arithmetic and geometric average returns for the stock?

-

Financial statement data for the years ended December 31 for Cottontop Corporation follow: a. Determine the earnings per share for 20Y3 and 20Y2. b. Does the change in the earnings per share from...

-

Haggen Cruises Inc. reported the following results for the year ended October 31, 20Y9: Retained earnings, November 1, 20Y8 ..... $11,775,000 Net income...

-

Sesimic Inc. reported the following results for the year ended June 30, 20Y5: Retained earnings, July 1, 20Y4 .... $1,700,000 Net income .......................................... 311,000 Cash...

-

To fund your dream around-the-world vacation, you plan to save $1,300 per year for the next 14 years starting one year from now. If you can earn an interest rate of 5.83 percent, how much will you...

-

On NSE (Indian stock exchange), shares of ICICI Bank trade for 935 rupees. If the spot exchange rate is USD 0.012, what is the no-arbitrage USD price of ICICI Bank ADR? Assume that transactions costs...

-

Income Statement Balance Sheet Balance Sheet Additional Financial Information 1. Market price of Ranfield's common stock: $90.44 at December 31, 2024, and $58.35 at December 31, 2023. 2. Common...

Study smarter with the SolutionInn App