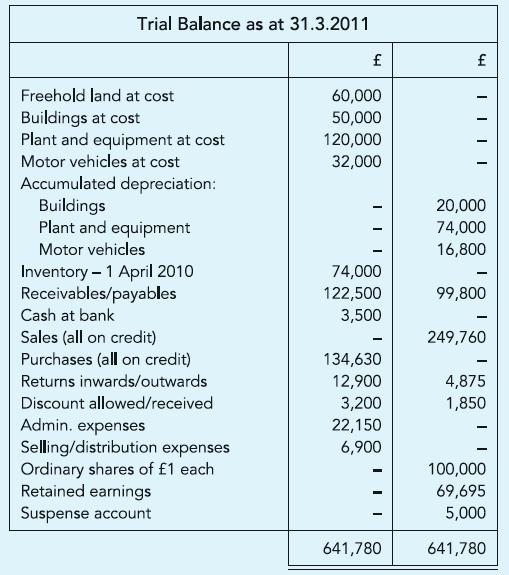

ABC Ltd extracted its year-end Trial Balance as shown below. You are further informed: (a) A vehicle

Question:

ABC Ltd extracted its year-end Trial Balance as shown below. You are further informed:

(a) A vehicle acquired for £14,000 and written down to £6,000 by 31.3.2010 was sold on that day for £5,000. The disposal has not been accounted for other than posting the proceeds to a Suspense account.

(b) Administrative expenses include £4,000, the amount by which tax paid on previous year’s profit exceeded the amount provided for.

(c) Cost of year-end inventory was £124,875.

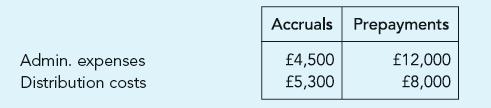

(d) As at the year-end adjustments need to be made as follows:

(e) Depreciation should be provided for as:

Buildings at 4% p.a. on cost

Plant and equipment at 20% p.a. on cost

Vehicles at 25% p.a. – reducing balance method.

(f) Tax on the profit earned in the year ended 31 March 2011 is estimated at £15,000.

Required:

Prepare for internal use the Statement of income for the year ended 31 March 2011, together with the Statement of changes in equity and the Statement of financial position as at 31.3.2011.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict