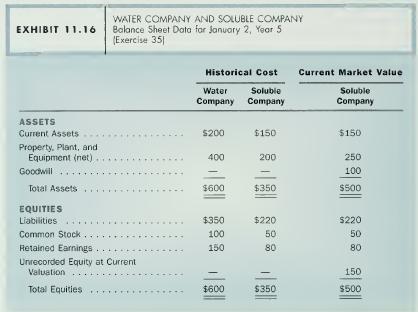

Financial statement effects of purchase and pooling-of-interests methods. (Requires coverage of Appendix I 1.2.) Exhibit 1 1.16

Question:

Financial statement effects of purchase and pooling-of-interests methods. (Requires coverage of Appendix I 1.2.) Exhibit 1 1.16 presents condensed balance sheet data for Water Company and Soluble Company on January 2, Year 5. On this date, Water Company exchanges common stock with a market value of $280 for all ol the outstanding common slock of Soluble Company.

a. Prepare a consolidated balance sheet for Water Company and Soluble Company as of January 2. Year 5. using (1) the purchase method and (2) the pooling-of- interests method.

b. Projected net income for Year 5 before consideration of the corporate acquisition was $60 for Water Company and $20 for Soluble Company. These firms intend to amortize any excess acquisition cost allocated to property, plant, and equipment over five years and any excess allocated to goodwill over 20 years. Compute the amount of consolidated net income projected for Year 5 assuming that these firms account for the corporate acquisition using (1) the purchase method and (2) the pooling-of-interests method.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil