Refer to the Appendix to Chapter 4 and the accounting for a manufacturing firm. A manufacturing firm

Question:

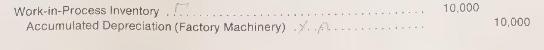

Refer to the Appendix to Chapter 4 and the accounting for a manufacturing firm. A manufacturing firm records depreciation on factory machinery (or equipment or buildings) with an entry such as the following:

Assume that none of the work in process was completed during the current accounting period. All sales were made from Finished Goods Inventory and there were no transfers from Work-in-Process Inventory to Finished Goods Inventory.

a Under these unrealistic assumptions, trace the effects of the above entry on the balance sheet accounts. Think about the totals of current assets, all assets, liabilities, and all equities.

b What is the effect of the above entry on working capital?

c Aside from income tax effects, can depreciation be a source of funds? Explain.

d What can you generalize from the above answers to a more realistic situation where part of the goods produced during the current period were sold?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney