The Johns and White Company, incorporated in 1969, manufactures a line of small electrical appliances for sale

Question:

The Johns and White Company, incorporated in 1969, manufactures a line of small electrical appliances for sale to local discount houses. At the time of incorporation, Johns and White each contributed \(\$ 150,000\), and a venture capital firm supplied \(\$ 250,000\). Business was good and profits grew steadily with only a slight decrease in the rate of growth of profits during the years 1973 and 1974. By 1976, Johns and White had bought out the venture capital firm's interest and were in sole command of the company.

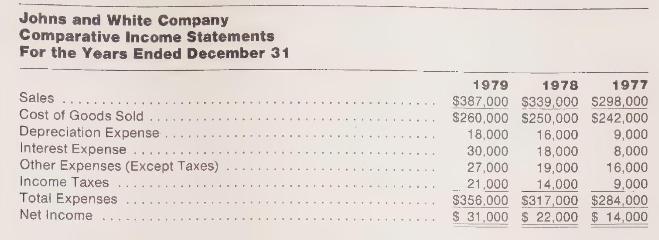

In 1977, feeling that the only constraint on their profitability was their limited manufacturing capacity, Johns and White began buying and rehabilitating old factories and equipping them to manufacture the Johns and White line of products. Johns and White intended to quadruple their 1977 manufacturing capacity by 1981. They financed the expansion through retained earnings and a series of 90 -day revolving notes with a local bank. During the years 1977, 1978, and 1979 Johns and White's profits continued to grow.

In late January 1980, Johns and White were informed simultaneously by their largest supplier and the bank that they had insufficient funds to cover their outstanding bills with the supplier. Johns and White were mystified. Over the years they had kept a careful watch on their profitability to ensure that they maintained their steady rate of growth of earnings. Their earnings for 1979 had been their highest ever. Over the years, however, they had paid little attention to their liquidity or working capital.

In consultation with the bank, it was brought out that Johns and White would need a large sum of money in the near future to finance inventories and continue formal operations. However, the bank stated that Johns and White had already borrowed beyond prudent levels and that the bank could not extend further loans to Johns and White under the existing terms. The terms imposed by the bank for a new loan would be such that not only would profitability be decreased due to the high interest rate on the additional loan and further expansion plans curtailed for the foreseeable future, but that Johns and White felt they would no longer be in full control of the Company.

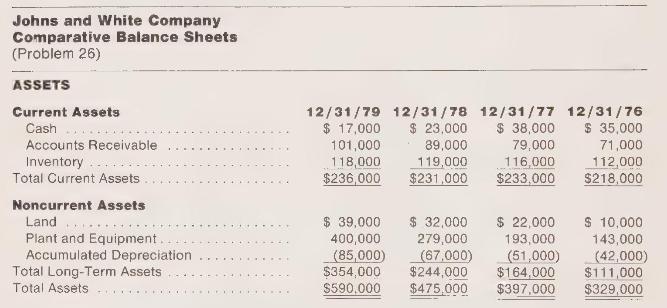

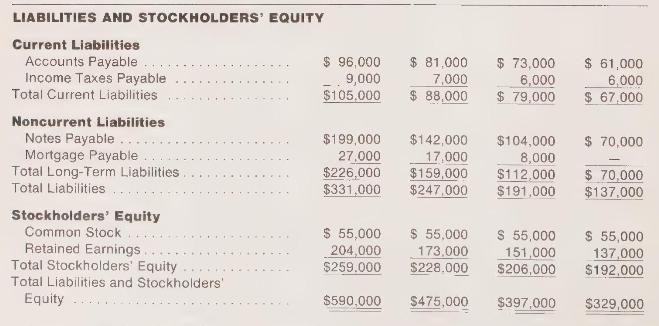

Explain what happened to Johns and White Company through the use of comparative statements of changes in financial position. Comparative balance sheets and income statements are presented here for the relevant periods.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney