The purpose of this problem is to convince you that depreciation expense uses no funds and that

Question:

The purpose of this problem is to convince you that depreciation expense uses no funds and that depreciation is not a source of funds. To carry out this exercise, get one writing pen, a dollar's worth of change, and a piece of paper. Put 40 cents, the writing pen, and the piece of paper on the other side of the desk and put 60 cents on your side of the desk.

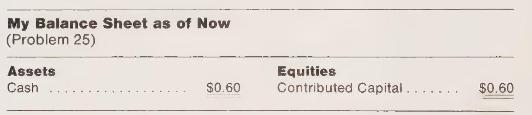

(1) Your balance sheet now looks like the one shown below.

(2) You are about to acquire a noncurrent asset, one long-lived writing pen. The pen costs 40 cents.

(3) Acquire the pen by exchanging 40 cents for the pen which is now across the desk. Record the following journal entry:

![]()

(4) Acquire the piece of paper, a current asset item, by trading 5 cents for the paper which is now across the desk. Record the following journal entry:

![]()

(5) Sign your name on the piece of paper you now have with the pen you acquired. (No journal entry required.)

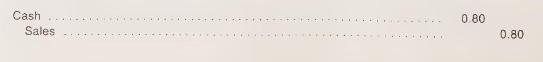

(6) Because of a sudden surge in your popularity, your autograph has become valuable. Sell your autograph to the other side of the table for 80 cents. Record the following journal entry:

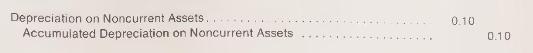

(7) The accounting period is over. Record an adjusting entry to recognize 10 cents depreciation for the period on the writing pen:

(8) Depreciation on Noncurrent Assets is, in this case, a cost of work-in-process inventory that is to be counted as part of Cost of Goods Sold. Record the following journal entry to measure Cost of Goods Sold.

(9) Close all temporary accounts with the following entry:

a Ignore income taxes. Prepare an income statement for the period just ended and a balance sheet as of the end of the period.

b Prepare a statement of changes in financial position for the period just ended. Start with net income and adjustments thereto.

Note: Observe that depreciation used no funds not otherwise counted in the nonoperating sources and uses. Funds were provided by selling one autograph. Notice that your funds on hand at the end of the period do not depend on the amount of depreciation on the pen for the period. If this is not clear, repeat \(\mathbf{a}\) and \(\mathbf{b}\) assuming depreciation of \(\$ 0.30\) or \(\$ 0.00\) in step (7).

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney