Donna Inc Donna Inc operates a defined benefit pension scheme for staff. The pension scheme has been

Question:

Donna Inc Donna Inc operates a defined benefit pension scheme for staff. The pension scheme has been operating for a number of years but not following IAS 19. The finance director is unsure of which accounting policy to adopt under IAS 19 because he has heard very conflicting stories. He went to one presentation in 20X3 that referred to a ‘10% corridor’ approach to actuarial gains and losses, but went to another presentation in 20X4 that said actuarial gains and losses could be recognised in equity.

The pension scheme had market value of assets of £3.2 million and a present value of obligations of

£3.5 million on 1 January 2002.There were no actuarial gains and losses brought forward into 2002.

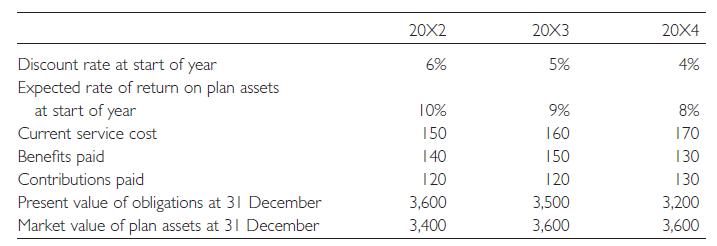

The details relevant to the pension are as follows (in 000s) are:

In all years the average remaining service lives of the employees was ten years. Under the 10% corridor approach any gains or losses above the corridor would be recognised over the average remaining service lives of the employees.

Required:

Advise the finance director of the differences in the approach to actuarial gains and losses following the ‘10% corridor’ and the recognition in equity. Illustrate your answer by showing the impact on the pension for 20X2 to 20X4 under both bases.

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273708704

11th Edition

Authors: Barry Elliott, Jamie Elliott