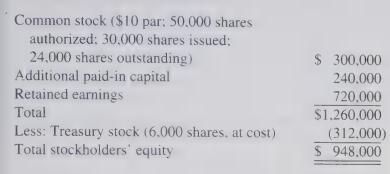

Accounting for Capital Stock Allstar Corporation reported the following stockholders equity balances at December 31: a. Were

Question:

Accounting for Capital Stock Allstar Corporation reported the following stockholders’ equity balances at December 31:

a. Were Allstar’s shares issued at par value or some other amount? What was the average amount received per share?

b. Why is there a maximum number of shares that can be issued without receiving shareholder approval? How many additional shares could be issued by Allstar before receiving shareholder approval?

c. What effect, if any, would the issuance of 5,000 additional shares of common stock at $64 per share have on the amount reported as additional paid-in capital? Retained earnings?

d. Why are treasury shares reported as a deduction from stockholders’ equity rather than a liability?

e. If the treasury shares were retired, what would be the effect on the stockholders’ equity accounts?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith