Ameritechs Interim Statements Ameritechs 1998 consolidated financial statements included the following note relating to its quarterly operating

Question:

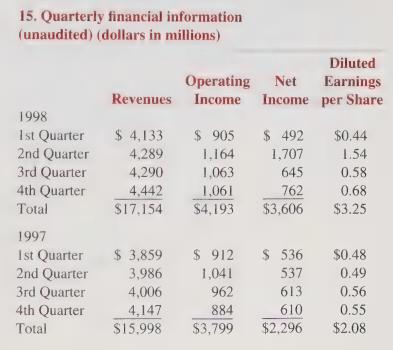

Ameritech’s Interim Statements Ameritech’s 1998 consolidated financial statements included the following note relating to its quarterly operating results:

The first quarter of 1998 includes a one-time pretax charge of $104 million ($64 million after-tax) for restructuring related to a cost containment program, as well as a one-time pretax charge of $54 million ($34 million after-tax) for a currency-related fair value adjustment in conjunction with our Tele Danmark investment. The second quarter of 1998 includes a one-time pretax gain of $1.5 billion ($1.0 billion after-tax) related to the sale of substantially all of our TCNZ shares. The fourth quarter of 1998 includes a one-time pretax charge of $38 million ($24 million after-tax) for the costs of early redemption of long-term debt, as well as a pretax gain of $170 million ($102 million after-tax) from the sale of certain telephone and directory assets to Century Telephone Enterprises, Inc.

The second quarter of 1997 includes a one-time after-tax charge of $87 million related to our share of the costs of a work force restructuring at Belgacom. The third quarter of 1997 includes a one-time pretax gain of $52 million ($37 million after-tax) resulting from the sale of our interest in Sky Network Television of New Zealand. Several other significant income and expense items were reported in the fourth quarter of 1997. However, the net result was not material to results for the quarter or year.

We calculated earnings per share on a quarter-by-quarter basis in accordance with GAAP. Quarterly EPS figures may not total EPS for the year due to fluctuations in the number of shares outstanding.

We have included all adjustments necessary for a fair statement of results for each period.

a. Compute the proportion of total revenue for the year that was reported in each quarter of 1997 and 1998. Do Ameritech sales appear to be seasonal?

b. Compute the proportion of operating income reported in each quarter of 1997 and 1998. Is the proportion of operating income for the year reported each quarter consistent with the proportion of total revenue reported?

c. Compute the proportion of net income for 1997 and 1998 earned in each quarter. Is the net income reported in each quarter consistent with the proportion of sales reported in the quarter?

d. The note contains information on a number of special charges and gains that were included in income during 1997 and 1998. Compute the amount that would have been reported as net income in each quarter of 1997 and 1998 if these special charges and gains (after tax) had not been reported.

e. With net income of $3,606 million reported in 1998 and $2,296 million reported in 1997, Ameritech has shown a sharp increase in net income in 1998. How does the analysis prepared in part d assist in evaluating the operating results between the 2 years?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith