Evaluation of Geographic Segments Archer Daniels Midlands 1998 consolidated financial statements included the following note relating to

Question:

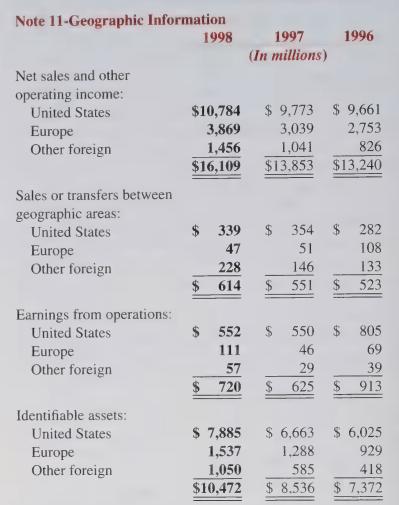

Evaluation of Geographic Segments Archer Daniels Midland’s 1998 consolidated financial statements included the following note relating to its operations in the United States, Europe, and other foreign locations:

Earnings from operations represent earnings before other income (expense) and income taxes.

Sales or transfers between geographic areas are made at established transfer prices.

Identifiable assets exclude cash and cash equivalents, marketable securities and investments in and advances to affiliates. At June 30, 1998, approximately $1.4 billion of the Company’s cash and cash equivalents, marketable securities and investments in affiliates were foreign assets, of which $681 million were in Europe.

a. What proportion of ADM’s 1998 net sales and other operating income was generated by each geographic region?

b. What proportion of ADM’s 1998 earnings from operations was generated by each geographic region? Did the contribution to earnings from operations of each region correspond to the net sales and other operating income for that region?

c. What proportion of ADM’s identifiable assets were invested in each geographic region during 1998?

d. What was the return on identifiable assets of each geographic region for 1998? On the basis of return on identifiable assets, which is the most successful geographic region? Would you arrive at the same conclusion after analyzing the data for 1996?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith