Morton International, Inc., with headquarters in Chicago, Illinois, manufactures specialty chemicals, automobile airbags, and salt. During 1996,

Question:

Morton International, Inc., with headquarters in Chicago, Illinois, manufactures specialty chemicals, automobile airbags, and salt. During 1996, the specialty chemicals business was reorganized, and three manufacturing plants were closed. Profits were generally high, however, mostly because of an improved product mix. The automotive airbag business did very well, with sales more than \(30 \%\) higher than the previous year. However, toward the end of the year, questions were being raised about the safety of airbags, and this put the future of this business in some jeopardy. The salt business had dramatically increased volume because of the demand for ice-control salt due to an unusually severe winter in the northeastern United States. However, ice-control salt has a low profit margin, and so profits were up only modestly.

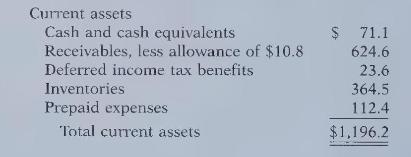

The current assets portion of Morton International's balance sheet follows. Dollar amounts are in millions. Morton's fiscal year ends June 30.

Assume that the following transactions occurred during March and April 1997:

1. Office supplies were shipped to Morton by Office Maxx, FOB destination. The goods were shipped March 30 and received March 31.

2. Morton purchased specialty plastic from Uniroyal Technology for use in airbag manufacture. The goods where shipped FOB shipping point April 1, and were received by Morton April 4.

3. Ford Motor Company purchased 10,000 airbags to be used in the manufacture of new cars. These were shipped FOB shipping point March 30, and were received by Ford April 2.

4. Bassett Furniture shipped office furniture to Morton, FOB destination, March 29. The goods were received April 3.

5. Inland Specialty Chemical shipped Morton chemicals that Morton uses in the manufacture of airbags and other items. The goods were sent FOB shipping point March 29, and were received April 1.

6. Morton purchased new automobiles for its executives from General Motors. The cars were shipped FOB destination March 19, and were received April 2.

7. Morton shipped salt to New York State Public Works, FOB Chicago, March 29. The shipment arrived in Chicago March 30 and in New York April 2.

8. Morton purchased steel, to be used in expanding its manufacturing plant, from Inland Steel, FOB Dallas. The steel was shipped March 30, arrived in Dallas April 2, and at Morton's plant April 6.

9. Morton shipped packaged salt to Associated Wholesale Grocers FOB Kansas City. The salt was shipped March 30, arrived in Kansas City April 1, and at Associated Wholesale Grocers' warehouse April 2.

\section*{Instructions}

Answer the following questions:

(a) Which items would be owned by Morton International as of March 31, 1997?

(b) Which transactions involve Morton's inventory account?

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9780471169192

1st Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso