One of the main suppliers to your business is Green Ltd, a family-owned business. It is the

Question:

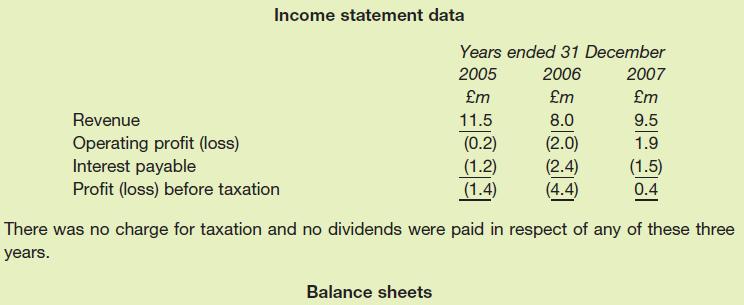

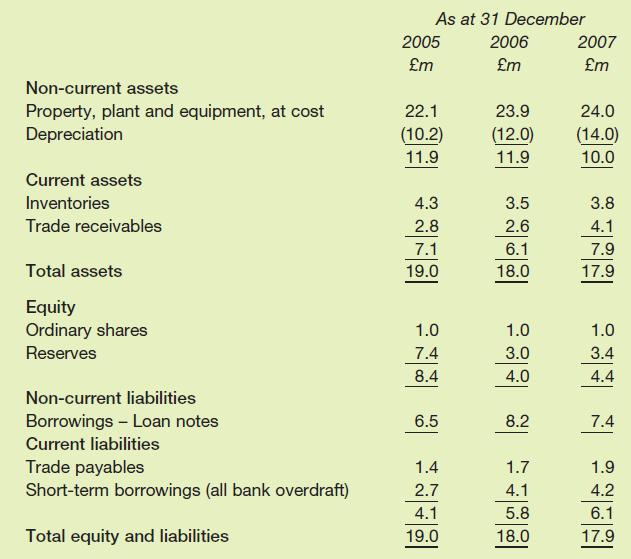

One of the main suppliers to your business is Green Ltd, a family-owned business. It is the only available supplier and your business buys 60 per cent of the Green Ltd's output. Recently, Green Ltd has run into a severe cash shortage and it requires extra finance to re-equip its fac- tory with modern machinery that is expected to cost 8 million. The machinery's life is expected to be ten years and savings, before depreciation, arising from its installation, are expected to be million a year. Green Ltd has approached your business to see if you are able to help with finance. The directors of Green Ltd have pointed out that, if it could acquire the new machinery, your business will be able to share in the benefits through reduced prices for supplies. Extracts from Green Ltd's recent financial statements are as follows:

Required:

(a) Calculate for each year and comment on each the following ratios for Green Ltd:

1 return on capital employed ratio;

2 acid test ratio;

3 trade receivables collection period (months) ratio;

4 interest cover ratio;

5 gearing ratio.

(b) Write some short notes suggesting the level and nature of the financial assistance that your business might be prepared to provide for Green Ltd. Your notes should also suggest what terms and conditions you would seek to impose.

Step by Step Answer:

Financial Accounting For Decision Makers

ISBN: 9781405888219

5th Edition

Authors: Dr Peter Atrill, Eddie Mclaney, Sin Autor