Prepaid Expenses and Supplies a. You are comparing the reported income and cash flow of two companies.

Question:

Prepaid Expenses and Supplies

a. You are comparing the reported income and cash flow of two companies. Company A lists a $50,000 prepaid expense in its balance sheet for an insurance policy on its buildings and equipment. In a footnote, Company A indicates that the policy is for two years, and one year has expired. Company B does not report any prepaid insurance in its balance sheet. Company A reports $50,000 of insurance expense in its income statement for this year and Company B reports insurance expense of $55,000.

1. In comparing the two companies, what effect will the prepaid expense have on the cash flow and current assets reported by Company A compared to Company B?

2. What amount should Company A report as insurance expense in the next year? What amount will Company B report?

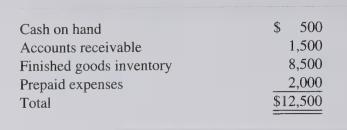

b. The bank you work for is considering lending money to a local bakery. In its loan application, the bakery listed the following amounts for cash on hand, accounts receivable, finished goods inventory, and prepaid expenses:

In the event of liquidation, what amounts are likely to be generated from the disposition of each of the assets?

Step by Step Answer:

Financial Accounting A Decision Making Approach

ISBN: 9780471328230

2nd Edition

Authors: Thomas E. King, Valdean C. Lembke, John H. Smith