Russell Ltd installs and services heating and ventilation systems for commercial premises. The businesss most recent statement

Question:

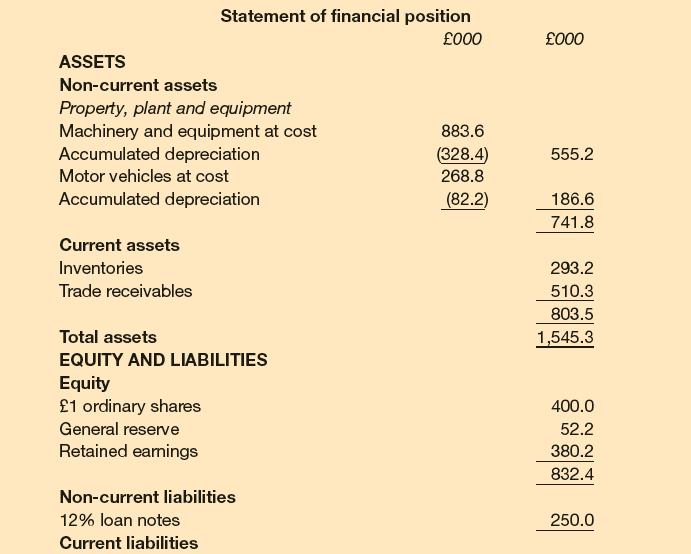

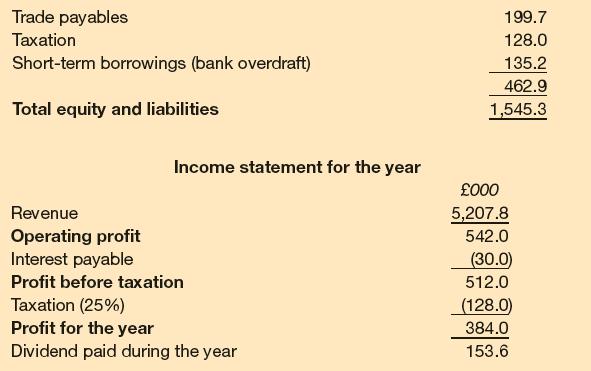

Russell Ltd installs and services heating and ventilation systems for commercial premises.

The business’s most recent statement of financial position and income statement are as follows:

The business wishes to invest in more machinery and equipment in order to cope with an upsurge in demand for its services. An additional operating profit of £120,000 a year is expected if £600,000 is invested in more machinery.

The directors are considering an offer from a private equity firm to finance the expansion programme. The finance will be made available immediately through either 1 an issue of £1 ordinary shares at a premium of £3 a share; or 2 an issue of £600,000 10 per cent loan notes at nominal value.

The directors wish to maintain the same dividend payout ratio in future years as in past years whichever method of finance is chosen.

Required:

(a) For each of the financing schemes:

1 prepare a projected income statement for next year;

2 calculate the projected earnings per share for next year;

3 calculate the projected level of gearing as at the end of next year.

(b) Briefly assess both of the financing schemes under consideration from the viewpoint of the existing shareholders.

Step by Step Answer: