Xerox Corporation has a 50% investment interest in a joint venture with the Japanese corporation Fuji, called

Question:

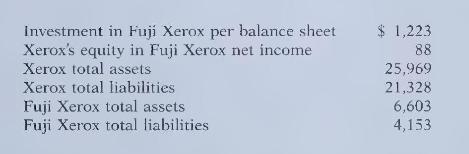

Xerox Corporation has a 50\% investment interest in a joint venture with the Japanese corporation Fuji, called Fuji Xerox. Xerox accounts for this investment using the equity method. The following additional information regarding this investment was taken from Xerox's 1995 annual report:

\section*{Instructions}

(a) What alternative approaches are available for accounting for long-term investments in stock? Discuss whether Xerox is correct in using the equity method to account for this investment.

(b) Under the equity method, how does Xerox report its investment in Fuji Xerox? If Xerox owned a majority of Fuji Xerox, it then would have to consolidate Fuji Xerox instead of using the equity method. Discuss how this would change Xerox's financial statements. That is, in what way and how much would assets and liabilities change?

(c) The use of \(50 \%\) joint ventures is becoming a fairly common practice. Why might companies like Xerox prefer to participate in a joint venture rather than own a majority share?

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9780471169192

1st Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso