At the start of business, the Miller Company acquired a ($100,000) piece of equipment that was to

Question:

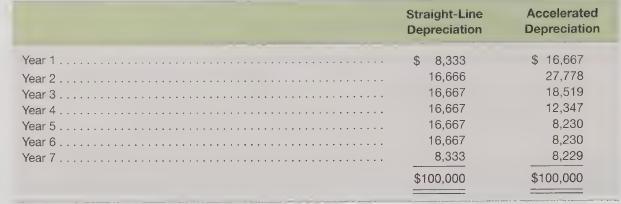

At the start of business, the Miller Company acquired a \($100,000\) piece of equipment that was to be depreciated on a straight-line method basis for financial statement purposes but on an accelerated depreciation basis for income tax purposes. The Miller Company employed a half-year convention under which only one-half of the first year’s depreciation expense would be taken regardless of when an asset was purchased and placed in service. The company also followed the accounting practice that if the level of accelerated depreciation charges fell below the level of straight-line depreciation charges (such as in Year 4 in the schedule below), the company would switch from accelerated depreciation to a straight-line approach. The company’s CFO prepared the following depreciation schedule for financial statement and income tax purposes.

Required

Assuming a 30 percent effective tax rate, prepare a schedule illustrating the deferred income tax effects for Year 1 through Year 7 associated with this asset. Which are more likely to be favorably viewed by the capital markets—deferred income tax assets or deferred income tax liabilities

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris