Calculating the Cumulative Foreign Currency Translation Adjustment.Graham International Ltd., an Australian Company, is a wholly owned but

Question:

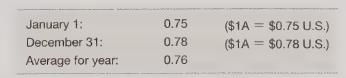

Calculating the Cumulative Foreign Currency Translation Adjustment.Graham International Ltd., an Australian Company, is a wholly owned but financially independent operating subsidiary of its U.S.-parent company and reports its financial results in Australian dollars. As of January 1, Graham International had a balance of \($(10,780)\) U.S. in its cumulative foreign currency translation adjustment account (see translated balance sheet). During the year, the exchange rates between the Australian and U.S. dollars were as follows:

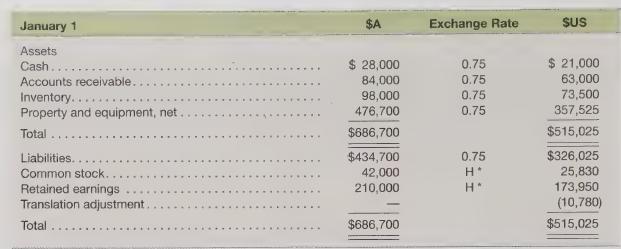

Graham International Ltd.’s balance sheet as of January 1 was as follows:

The historical exchange rate in effect at the time the account balance was created.

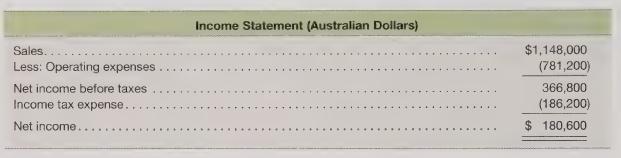

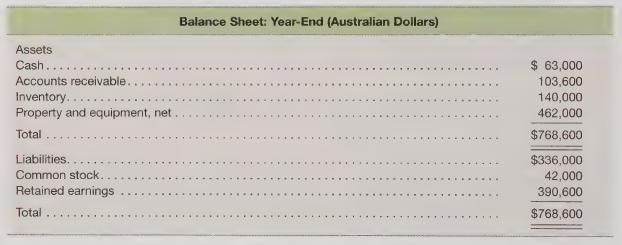

At the end of the year Graham International’s income statement and balance sheet appeared as follows:

Required

1. Translate Graham International’s income statement using the average exchange rate for the year.

2. Translate Graham International’s year-end balance sheet using the current rate method (all assets and liabilities are translated at the end-of-year exchange rate).

3. Explain the change in Graham’s cumulative foreign currency translation adjustment from \($(10,780)\) at the beginning of the year, to \($392\) at year-end. Why did the currency translation adjustment increase from an unrealized loss to an unrealized gain? When will this unrealized gain be realized?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris