Consider a publicly held company whose products you are familiar with. Some examples might include: Access the

Question:

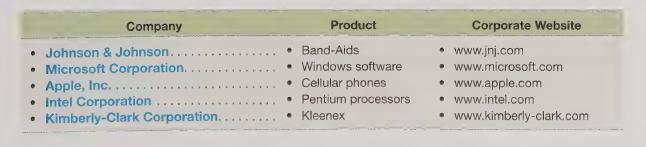

Consider a publicly held company whose products you are familiar with. Some examples might include:

Access the company’s public website and search for its most recent annual report. (Some companies provide access to their financial data through an “investor relations” link, while others provide a direct link to their “annual reports.”) After locating your company’s most recent annual report, open the file and review its contents.

After reviewing the annual report for your selected company, prepare answers to the following questions:

a. Calculate the total debt to total assets ratio for the past two years. Is the company principally debtfinanced or equity-financed? Do you agree with this strategic decision?

b. Review the company’s long-term debt footnote. What kinds of debt—bonds, notes, zero-coupon bonds—does the company have outstanding? Are the debt instruments denominated in U.S. dollars? If not, why not?

c. What is the company’s weighted-average cost of debt? What is the company’s return on assets? Can the company use leverage effectively?

d. Does the company use leases to finance any of its assets? If so, what kind of leases—operating or capital—does the company use?

e. Calculate the company’s interest coverage ratio for the past two years. What is the trend in this ratio? Why?

What is your assessment of the company’s liquidity and solvency? What did you base your opinion on?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris