CVS Corporation discloses the following as part of its long-term debt footnote in its (10-mathrm{K}). section*{BORROWING AND

Question:

CVS Corporation discloses the following as part of its long-term debt footnote in its \(10-\mathrm{K}\).

\section*{BORROWING AND CREDIT AGREEMENTS}

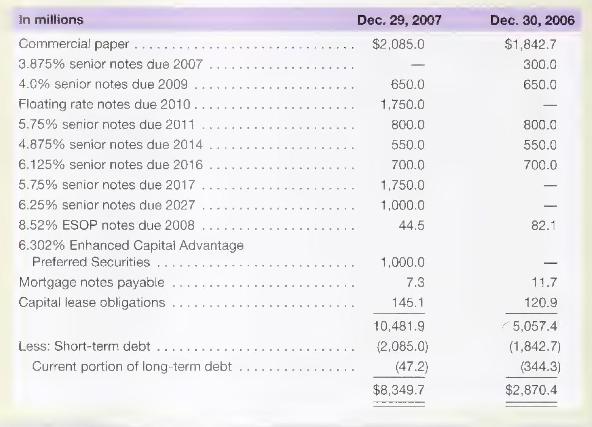

Following is a summary of the Company's borrowings as of the respective balance sheet dates.

CVS also discloses the following information.

Interest expense, net-Interest expense was \(\$ 468.3\) million, \(\$ 231.7\) million and \(\$ 117.0\) million, and interest income was \(\$ 33.7\) million, \(\$ 15.9\) million and \(\$ 6.5\) million in 2007,2006 and 2005 , respectively. Interest paid totaled \(\$ 468.2\) million in \(2007, \$ 228.1\) million in 2006 and \(\$ 135.9\) million in 2005.

Maturities of long-term debt-The aggregate maturities of long-term debt for each of the five years subsequent to December 29,2007 are \(\$ 47.2\) million in \(2008, \$ 653.0\) million in \(2009, \$ 1.8\) billion in \(2010, \$ 803.9\) million in 2011 and \(\$ 1.0\) billion in 2012.

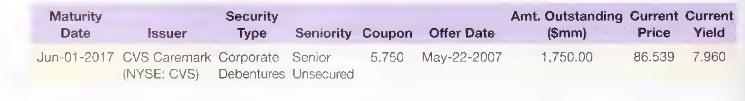

The price of the \(\$ 1,750\) million \(5.75 \%\) senior notes due 2017 as of December 2008 follows (from ( untini il):

\section*{Required}

a. What is the average coupon rate (interest paid) and the average effective rate (interest expense) on CVS' long-term debt? (Hint: Use the disclosure for interest expense.)

b. Does your computation of the coupon rate in part \(a\) seem reasonable given the footnote disclosure relating to specific bond issues? Explain.

c. Explain how the amount of interest paid can differ from the amount of interest expense recorded in the income statement

d. On its 2007 balance sheet, CVS reports current maturities of long-term debt of \(\$ 47.2\) million as part of short-term debt. Why is this amount reported that way? CVS reports \(\$ 1.8\) billion of longterm debt maturing in 2010. What does this mean? Is this amount important to our analysis of CVS? Explain.

e. The \(\$ 1,750\) million \(5.75 \%\) senior unsecured debentures maturing in 2017 are priced at 86.539 ( \(86.539 \%\) of face value, or \(\$ 1,514\) million) as of December 2008 , resulting in a yield to maturity of \(7.96 \%\). Assuming that the credit rating of CVS has not changed, what does the pricing of this \(5.75 \%\) coupon bond imply about interest rate changes since CVS issued the bond?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally