The Pepsi Bottling Group reports ($ 4,788) million of long-term debt outstanding as of December 2007 in

Question:

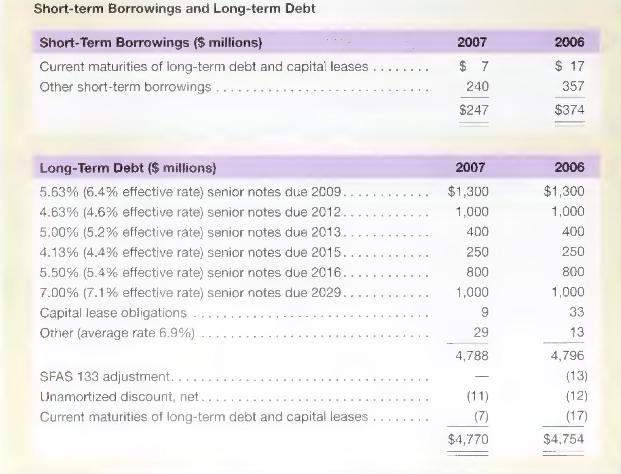

The Pepsi Bottling Group reports \(\$ 4,788\) million of long-term debt outstanding as of December 2007 in the following schedule to its \(10-\mathrm{K}\) report.

Debt Covenants Certain of our senior notes have redemption features and non-financial covenants that will, among other things, limit our ability to create or assume liens, enter into sale and lease-back transactions, engage in mergers or consolidations and transfer or lease all or substantially all of our assets. Additionally, certain of our credit facilities and senior notes have financial covenants consisting of the following:

- Our debt to capitalization ratio should not be greater than . 75 on the last day of a fiscal quarter when PepsiCo's ratings are A- by S\&P and A3 by Moody's or higher. Debt is defined as total long-term and short-term debt plus accrued interest plus total standby letters of credit and other guarantees less cash and cash equivalents not in excess of \(\$ 500\) million. Capitalization is defined as debt plus shareholders' equity plus minority interest, excluding the impact of the cumulative translation adjustment.

- Our debt to EBITDA ratio should not be greater than five on the last day of a fiscal quarter when PepsiCo's ragings are less than A- by S\&P or A3 by Moody's. EBITDA is defined as the last four quarters of earnings before depreciation, amortization, net interest expense, income taxes, minority interest, net other non-operating expenses and extraordinary items.

- New secured debt should not be greater than 15 percent of our net tangible assets. Net tangible assets are defined as total assets less current liabilities and net intangible assets.

As of December 29, 2007 we were in compliance with all debt covenants.

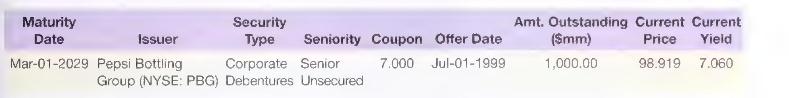

As of December 2008, the price of the \(\$ 1,000\) million \(7 \%\) senior notes due 2029 follows (from Capital \(\mathrm{IQ})\) :

\section*{Required}

a. PBG reports current maturities of long-term debt of \(\$ 7\) million as part of short-term debt. Why is this amount reported that way? PBG reports \(\$ 1,300\) million of long-term debt due in 2009. What does this mean? Is this amount important to our analysis of Pepsi Bottling Group? Explain.

b. The \(\$ 1,000\) million \(7 \%\) senior notes maturing in 2029 are priced at \(98.919(98.919 \%\) of face value, or \(\$ 989.19\) million) as of December 2008 , resulting in a yield to maturity of \(7.06 \%\). Assuming that the credit rating of PBG has not changed, what does the pricing of this \(7 \%\) coupon bond imply about interest rate changes since PBG issued the bond?

c. PBG identifies a number of financial covenants relating to its long-term debt. Describe each of these covenants and how they affect our financial analysis.

d. PBG reports an unamortized discount of \(\$ 11\) million. How does a discount arise and what effect will its amortization have on reported interest expense?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally