Dean Foods Company, a food and beverage company headquartered in Dallas, Texas, is one of the nations

Question:

Dean Foods Company, a food and beverage company headquartered in Dallas, Texas, is one of the nation’s largest processors and direct-to-store distributors of fluid milk. Consistent with U.S. GAAP, Dean Foods annually performs an impairment test of its goodwill.

In its 2011 annual report, Dean Foods reports the following information regarding its annual impairment test of goodwill. (At the time, Dean Foods had three reporting units: Fresh Dairy Direct, WhiteWave-Alpro, and Morningstar.)

They concluded the implied fair value of our Fresh Dairy Direct goodwill was \($87\) million.

Required

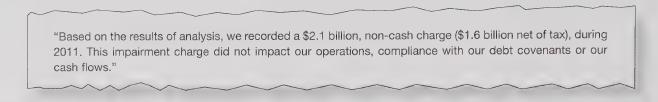

1. What were the financial effects on Dean Food’s 2011 financial statements (income statement, balance sheet, statement of cash flow) associated with its 2011 goodwill impairment write-off?

2. Assume that Dean Food had substantial borrowings secured by its U.S. assets and under these credit agreements, the company is subject to a number of debt covenants that required a certain level of debt to total assets. How would the 2011 goodwill impairment and related write-off have affected the company’s ability to meet its debt covenants?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris