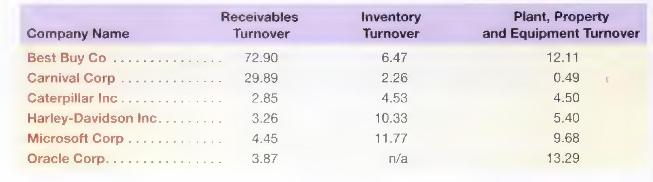

Following are asset turnover rates (using year-end account values) for accounts receivable; inventory; and property, plant, and

Question:

Following are asset turnover rates (using year-end account values) for accounts receivable; inventory; and property, plant, and equipment (PPE) for Best Buy (retailer of consumer products), Carnival (vacation cruise line), Caterpillar (manufacturer of heavy equipment), Harley-I) avidson (manufacturer of motorcycles), Microsoft (software company), and Oracle (software company).

Required

a. Interpret and explain differences in receivables turnover for the retailer (Best Buy) vis--vis that for the manufacturers (Caterpillar and Harley-Davidson).

b. Interpret and explain the difference in inventory turnover for Harley-Davidson versus Caterpillar. Why is Oracle's inventory turnover reported as n.a.?

c. Interpret and explain the difference in PPE turnover for Carnival versus Microsoft.

d. What are some general observations you might draw regarding the relative levels of these turnover rates across the different industries?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally